Explore the most trusted PEM electrolyzer OEM suppliers globally. Streamline your hydrogen production supply chain today with the right manufacturing ally.

Introduction — why supplier choice matters

Green hydrogen is moving from pilots to industrial scale. PEM (proton exchange membrane) electrolyzers lead the pack where space, purity and fast dynamic response matter — such as mobility fueling, on-site industrial feedstock, and tightly coupled renewables. That makes selecting experienced PEM electrolyzer OEM suppliers a commercial decision, not just a technical one: the right OEM reduces capex, lowers lifetime operating cost, shortens lead times, and improves uptime.

This guide helps you:

- Compare the leading OEMs and new entrants in 2025;

- Understand the procurement considerations only experienced buyers worry about (capacity, warranty, performance curves, spares/logistics, OEM custom work); and

- Decide when a factory-direct supplier (like Hele Titanium Hydrogen) is the right fit for price-sensitive, export-driven projects.

Throughout the piece you’ll find short supplier profiles, a buyer checklist, real-world project proof points, and clear next steps to request quotes or technical specs.

Quick primer — what makes PEM different and where it’s best used

PEM electrolysis uses a solid polymer membrane that conducts protons (H⁺) while acting as an electronic insulator and gas barrier. Compared with alkaline systems, PEM stacks are compact, tolerate variable power inputs from wind/solar, and produce very high-purity hydrogen — ideal for fuel cell, mobility, and high-purity industrial needs.

Key advantages

- Rapid response & dynamic operation — good for pairing with renewables.

- High purity hydrogen suitable for fuel cells.

- Small footprint & modular scale-up compared with large alkaline plants.

Tradeoffs

- Higher stack material costs (precious metal catalysts) — though ongoing R&D and gigafactory manufacturing are reducing stack costs.

- Historically higher capex per kW for small units; this gap is narrowing as OEMs scale production. For market context and growth estimates see the IEA and Hydrogen Council data on electrolyser expansion. (IEA, Hydrogen Council)

What to evaluate when sourcing PEM electrolyzer OEM suppliers

When your procurement team shortlists PEM electrolyzer OEM suppliers, score them against technical, operational and commercial metrics:

- Proven stack & system performance

- Ask for IV curves, efficiency at the operating load, degradation rates (µV/1000h or %/1000h), and independent test data.

- Manufacturing capacity & scale

- Can the OEM ramp to meet multi-MW or GW orders? Gigafactories are reshaping cost and delivery. (See examples later.) (Electric Hydrogen, pv magazine International)

- Certifications & standards

- ISO 9001, CE/UKCA, and, where applicable, other local approvals. Also check CE/ATEX for hazardous areas.

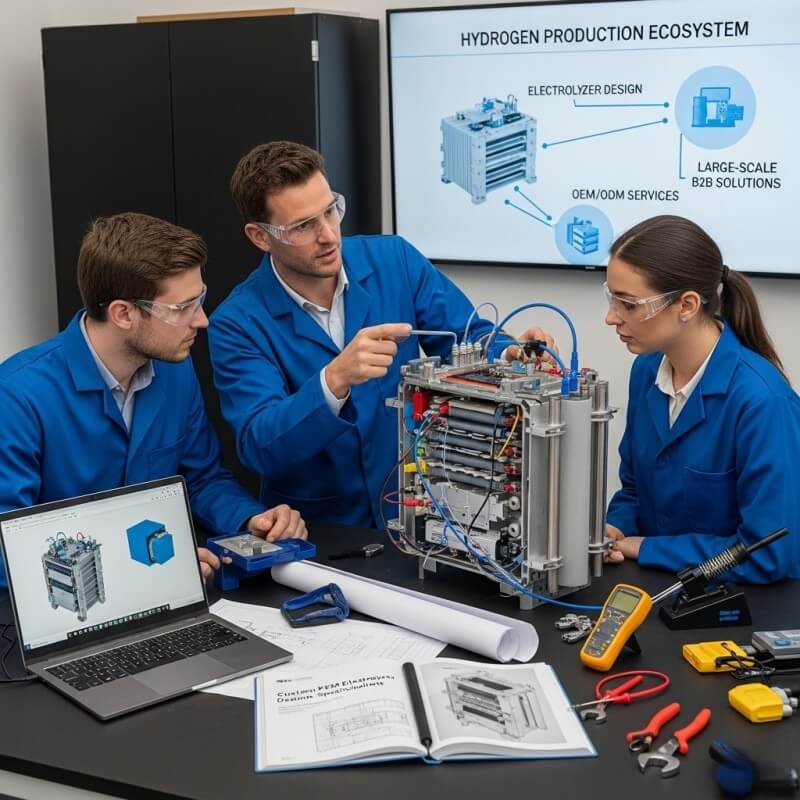

- Customization & OEM/ODM capabilities

- Does the OEM offer containerized solutions, high-pressure options, or integrated balance-of-plant (BOP) packages?

- Testing, QA & traceability

- Factory acceptance testing (FAT), stack traceability, and documented failure-mode analysis.

- After-sales, spares & remote support

- Mean time to ship spare stacks, local stocking, remote diagnostics, and training programs.

- Warranty & lifetime economics

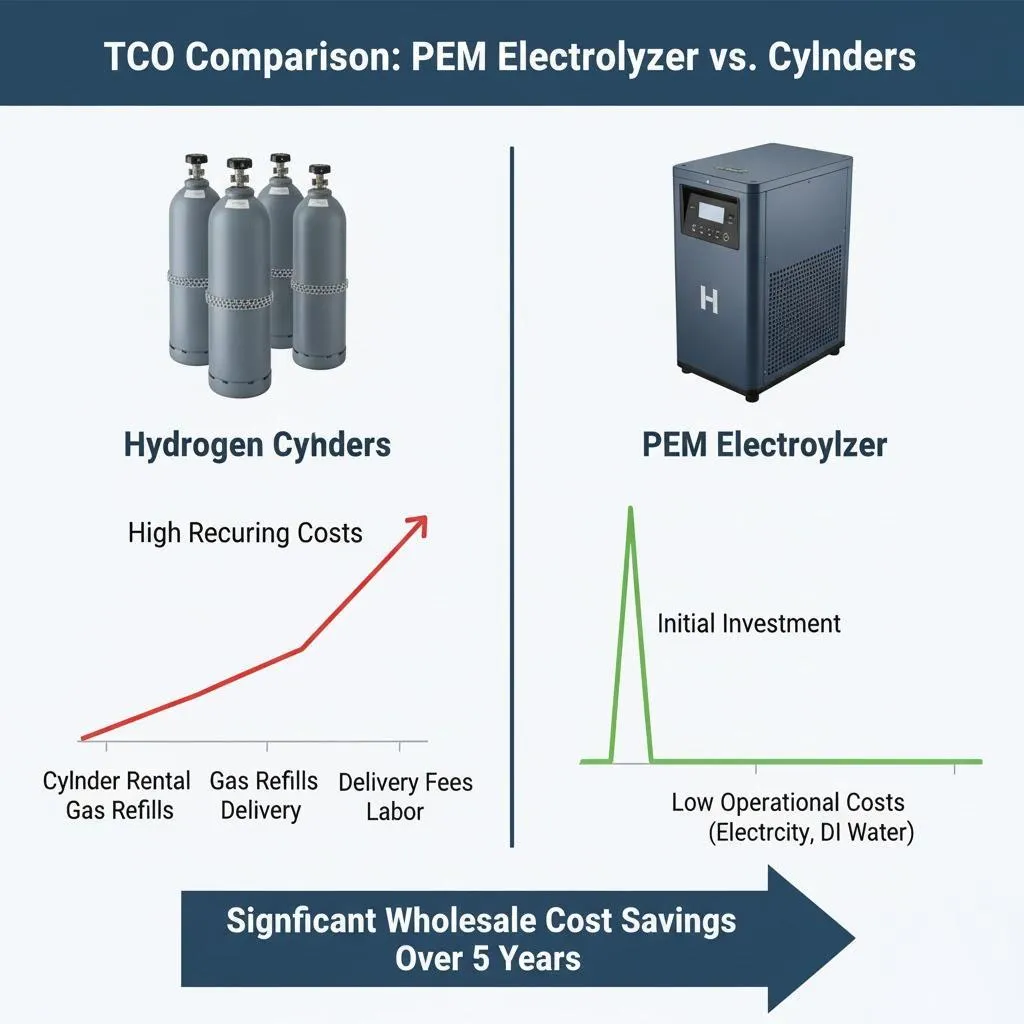

- Compare not just capex but modeled TCO: stack replacement schedule, electrical efficiency, parasitic loads, and maintenance windows.

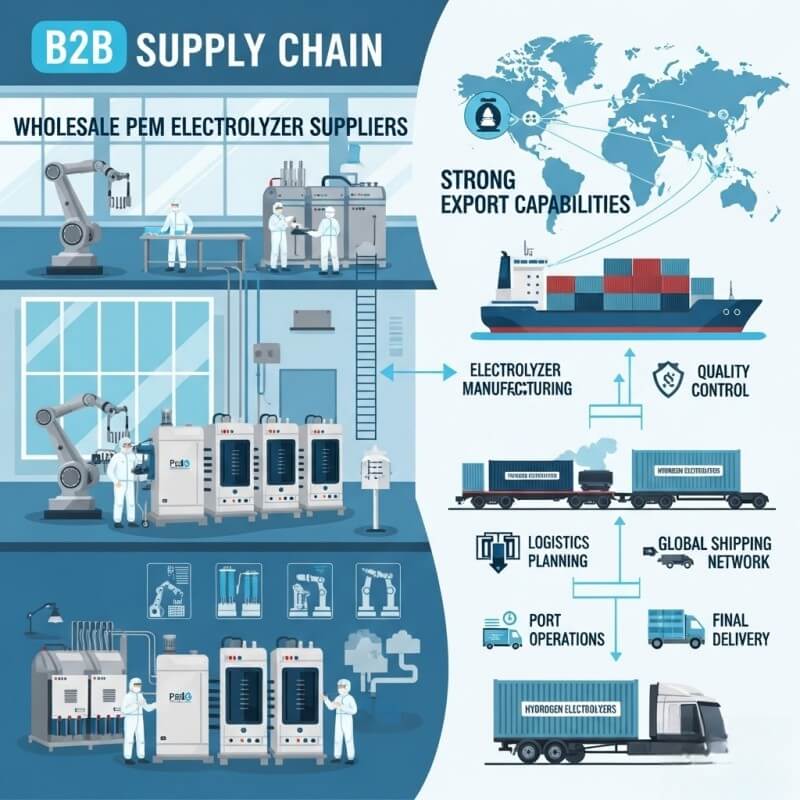

- Logistics & export experience

- For cross-border projects, OEMs experienced in export packaging, customs, payment terms (L/C, D/P) and logistics avoid costly delays.

- Financial stability & track record

- Supplier financial health impacts long lead procurements and long warranty obligations. Use public filings / press coverage to verify. (Fuel Cells Works)

Score vendors on each item, weight the list to your priorities, and require a standard RFP data sheet to allow apples-to-apples technical and commercial comparisons.

Top PEM electrolyzer OEM suppliers for 2025 — profiles & proof points

Note: the companies below are selected based on production capacity announcements, public orders and known technology footprints. This is not exhaustive — use it as a short-list starting point and verify project-specific fit with each OEM.

ITM Power — UK (modular NEPTUNE systems; factory investment & order flow)

ITM Power is a long-standing PEM specialist with modular NEPTUNE product lines and a large UK manufacturing footprint. In 2025 ITM continued commercial activity and NEPTUNE unit sales into European grid projects. Recent contracts and financial reporting show active order flow and continued product launches for industrial and decentralized hydrogen services. (ITM Power, Fuel Cells Works)

Best for: modular, mid-to-large industrial projects and customers who want proven European engineering.

Nel ASA — Norway (PEM & alkaline; gigafactory expansions + mixed near-term outlook)

Nel is one of the oldest dedicated electrolyser companies and has invested heavily in PEM and alkaline production lines, signaling gigawatt ambitions. The company expanded production capacity with automated lines that were expected to ramp into 2025, though recent business updates show order timing and revenue volatility across 2024–2025. Buyers should weigh Nel’s production scale with near-term backlog timing. (Nel Hydrogen, Fuel Cells Works)

Best for: buyers looking for an OEM with dual-technology capabilities and large project experience (subject to verifying current lead times).

Siemens Energy (Silyzer family) — Germany (industrial scale, integrated solutions)

Siemens Energy offers the Silyzer/Elyzer PEM family engineered for large-scale plant integration and high power density. Siemens positions Silyzer systems for coupling with industrial loads (steel, chemical feedstock) and grid-scale renewables. Their product pages and project descriptions highlight modular stacks and integrated plant controls. (Siemens Energy)

Best for: industrial EPCs and utilities seeking turn-key, full-stack integration.

Electric Hydrogen (EH2) — USA (high-power PEM stacks & gigafactory approach)

Electric Hydrogen designs ultra-high-power PEM stacks and announced a 1.2 GW nameplate gigafactory in Massachusetts to mass-manufacture large plant electrolyzers. EH2 has published multi-hundred-MW framework agreements and public project selections, positioning itself as a low-LCOH (levelized cost of hydrogen) OEM for large hydrogen hubs. (Electric Hydrogen)

Best for: very large green-hydrogen plants and projects targeting LCOH reductions through high-power stack designs.

Bosch (Hybrion stacks) — Germany (automotive & parts-scale manufacturing)

Bosch entered electrolyser parts and PEM stack production leveraging its manufacturing scale and fuel-cell experience. In 2025 Bosch showed Hybrion PEM stacks (2.5 MW module examples) and early orders; its strategy is to leverage volume automotive and industrial manufacturing to cut stack costs. (Reuters, Bosch Media Service US)

Best for: integrated OEM component supply chains and customers valuing industrial-grade manufacturing.

Cummins (Accelera / Hydrogenics heritage) — USA/Global (industrial deployments)

Cummins combines historical Hydrogenics tech with new Accelera branding; it is capable of multi-MW PEM deliveries and announced large systems deliveries (e.g., a 35 MW PEM system for industrial hydrogen production in 2025). Their global service footprint is an advantage for international buyers. (Cummins Inc.)

Best for: buyers seeking global aftermarket support and large modular systems.

McPhy (France — note: restructuring activity)

McPhy historically focused on PEM & alkaline mobility systems and gigafactory plans, but the company has undergone financial restructuring and asset sales in 2025. For buyers considering McPhy parts or mobility solutions, validate production commitments and post-sale support before contracting. (GlobeNewswire, mcphy-finance.com)

Best for: regional European projects — verify current financial/ownership status.

Fortescue Future Industries (Australia) — new entrant with big factory (watch closely)

Fortescue opened a large PEM electrolyser facility near Gladstone with >2 GW nameplate production ambitions; however, in 2025 some capacity and staffing decisions created uncertainty around long-term output. If you consider Fortescue as an OEM supplier, confirm current manufacturing status and warranty/fulfilment guarantees. (pv magazine International, pv-magazine-australia.com)

Best for: projects in Australia and APAC — only if recent manufacturing and staffing status is verified.

Supplier comparison (quick view)

| Company | HQ | Strength / Differentiator | Typical project scale | Notes / What to check |

|---|---|---|---|---|

| ITM Power | UK | Modular NEPTUNE systems, European engineering | 1–100 MW | Verify delivery slots & service in region. (ITM Power) |

| Nel ASA | Norway | PEM & alkaline, automated electrode lines | 10–500+ MW | Confirm backlog & ramp status. (Nel Hydrogen, Fuel Cells Works) |

| Siemens Energy | Germany | Turn-key plant integration (Silyzer) | 10–100+ MW | Strong for industrial integration. (Siemens Energy) |

| Electric Hydrogen | USA | High-power stacks, gigafactory scale | 100 MW–GW | Best for very large hubs; check delivery framework. (Electric Hydrogen) |

| Bosch | Germany | Component scale, mass production | 2–10+ MW modules | Good for automotive/industrial supply chains. (Reuters) |

| Cummins (Accelera) | USA | Global service and modular systems | 5–50+ MW | Strong aftermarket network. (Cummins Inc.) |

| McPhy | France | Mobility & on-site systems (restructuring) | 1–20 MW | Validate assets/ownership. (mcphy-finance.com) |

| Fortescue FFI | Australia | Large planned capacity (2 GW plant) | 10–GW ambitions | Confirm current operations. (pv magazine International, pv-magazine-australia.com) |

Case studies & commercial proof (short examples)

- Electric Hydrogen — AES & Uniper: EH2’s technology has been selected for large utility-scale projects and framework supply agreements for multi-100 MW deployments — illustrating the trend toward big, standardized plant modules. (Electric Hydrogen)

- ITM Power — NEPTUNE deliveries: ITM continues to place containerized NEPTUNE units with DSO and industrial customers across Europe, demonstrating the value of modular, containerized OEM supply for decentralized hydrogen projects. (ITM Power, Fuel Cells Works)

- Cummins (Accelera) — 35 MW delivery: Accelera’s recent large unit shows OEMs can produce multi-tens of megawatt PEM systems for industrial offtake customers. (Cummins Inc.)

Where Hele Titanium Hydrogen fits (factory-direct OEM for export & wholesale)

As a professional manufacturer and wholesale supplier of PEM water hydrogen generators, Hele Titanium Hydrogen is positioned to help international buyers who want:

- Factory-direct pricing and flexible MOQ for OEM/ODM orders;

- Custom BOP integration (containerized or skid-mounted units) to your specsheet;

- Export experience — trade documentation, export packaging, and logistics for cross-border projects; and

- Fast sample or pilot shipments to validate performance before committing to larger volumes.

If your project needs competitive pricing, flexible customization, and an experienced export partner, contact Hele Titanium Hydrogen for:

- A free technical spec sheet and stack performance data;

- A TCO calculator tailored to your electricity price and operating profile; or

- A no-obligation quotation for containerized PEM modules sized to your use case.

(Insert company contact link / email / lead form — place your contact details here.)

Emerging trends buyers should watch

- Gigafactories compressing costs — large-scale automated stack production (1+ GW plants) is beginning to reshape pricing expectations for PEM stacks. Examples include EH2’s 1.2 GW Devens gigafactory and Fortescue’s Gladstone facility announcements — both intended to cut stack costs by volume. (Electric Hydrogen, pv magazine International)

- Manufacturing & supply risk — some new entrants and expansions have faced staffing, funding or backlog issues; perform careful due diligence on delivery guarantees and insolvency risk. Recent company updates show volatility for some suppliers in 2025. (Fuel Cells Works, mcphy-finance.com)

- System integration & value-add — buyers prefer OEMs that supply balanced systems (BOP, controls, compression) and O&M frameworks rather than stacks only.

- Local content & policy — national clean hydrogen strategies and subsidies (e.g., IRA, EU funds, Australia MMI) shape where buyers choose OEMs because of incentive eligibility and procurement rules. See IEA and Hydrogen Council market analysis. (IEA, Hydrogen Council)

Frequently asked questions (B2B buyers)

Q1 — What lead times should I expect for PEM electrolyzer OEM supplies?

A1 — Lead times vary by vendor and order size: small demo units (kW range) can be shipped weeks–months; containerized modules 3–6 months; large MW-scale orders can be 9–24+ months depending on backlog and stack supply.

Q2 — Do manufacturers offer OEM/ODM customization?

A2 — Most modern PEM OEMs provide OEM/ODM services (controls, packaging, instrumentation). Ask for documented change-order processes and engineering change approval timelines.

Q3 — How do I compare warranties?

A3 — Ask for warranty coverage on the stack, on the full system, and for availability guarantees. Use performance guarantees (availability %, degradation rates) to model lifetime replacement cost.

Q4 — What payment terms are typical for international orders?

A4 — Common terms: deposit (30%), stage payments, balance on delivery or L/C at sight. For large projects, tailored financing and escrow arrangements are common.

Q5 — Should I buy from a Tier-1 OEM or a factory-direct supplier?

A5 — Tier-1 OEMs offer risk mitigation, global service, and integration experience. Factory-direct suppliers (Hele Titanium Hydrogen style) can deliver lower price, shorter negotiation cycles and flexible customization—good when you have capable local installation partners.

Q6 — How do I verify technical claims?

A6 — Require FAT, third-party test reports, and references to commissioned plants. For big purchases, include independent performance verification in the contract.

Conclusion & next steps

The PEM electrolyzer market is maturing quickly in 2025. Established OEMs, deep-pocketed industrial entrants, and gigafactory-scale manufacturers are reshaping supply and price dynamics. As a buyer, prioritize technical verification, clear delivery commitments, and total cost modeling.

If you’re sourcing PEM electrolyzer OEM suppliers for a project, here’s a practical next step:

- Download our Free Procurement Checklist & RFP Template (technical + commercial): it standardizes vendor responses so you can compare quotes fairly.

- Request a pilot quote and stack performance datasheet from Hele Titanium Hydrogen — factory-direct pricing gives you negotiating leverage.

- Ask shortlisted vendors for FAT dates and reference installations within your region.

Contact Hele Titanium Hydrogen to get the spec sheet, a sample TCO run, or a tailored proposal for containerized PEM modules — send an inquiry with your target capacity (kW–MW), project location, and preferred delivery window.

Sources & further reading

- IEA, Global Hydrogen Review 2024. (IEA)

- Hydrogen Council, Hydrogen Insights 2024. (Hydrogen Council)

- Electric Hydrogen — gigafactory & project news. (Electric Hydrogen)

- ITM Power — NEPTUNE project & FY25 reporting. (ITM Power, Fuel Cells Works)

- Bosch — Hybrion PEM stacks announcement. (Reuters, Bosch Media Service US)

- Siemens Energy — Silyzer / Elyzer product pages. (Siemens Energy)

- Nel ASA — PEM production expansion and market update. (Nel Hydrogen, Fuel Cells Works)

- Cummins (Accelera) — 35 MW delivery press release. (Cummins Inc.)

- McPhy — public company updates and restructuring. (GlobeNewswire, mcphy-finance.com)

- Fortescue Future Industries — Gladstone electrolyser factory reporting + later staffing/uncertainty. (pv magazine International, pv-magazine-australia.com)

If you’d like, I can now:

- Convert this into a downloadable one-page procurement checklist and RFP template tailored to your product specs;

- Draft an email template to send to shortlisted OEMs requesting a quote; or

- Build a two-column landing page version to drive B2B inquiries to Hele Titanium Hydrogen (with lead capture).

Tell me which of those you want first and I’ll deliver it right away.

Hele Titanium Hydrogen: Your Trusted Hydrogen Generator OEM & Manufacturing Partner

Hele Titanium Hydrogen stands as a reliable and experienced partner in the hydrogen generator OEM supply chain. We specialize in the design, development, and manufacturing of high-performance PEM Water Hydrogen Generators, offering comprehensive OEM & Manufacturing services tailored to your specific needs.

Take the Next Step

Ready to explore the possibilities of partnering with Hele Titanium Hydrogen?

- Browse our Products to see our range of PEM Water Hydrogen Generators.

- Learn more about our Services and how we can support your OEM & Manufacturing needs.

- Contact Us today to discuss your specific requirements.

- Explore our FAQ to get answers to common questions.

- Visit our Blog for the latest insights and updates on hydrogen technology.

Email Us: heletitaniumhydrogen@gmail.com

Phone/WhatsApp: 086-13857402537