The global industrial hydrogen market is experiencing unprecedented growth, with demand projected to reach 500 million tons by 2050. At the forefront of this transformation are industrial PEM water electrolyzers, which offer unparalleled efficiency, flexibility, and scalability for large-scale hydrogen production. This comprehensive guide examines the leading technologies, manufacturers, and implementation strategies that are reshaping industrial hydrogen production worldwide.

Executive Summary for Decision Makers

Industrial PEM water electrolyzers represent the most advanced solution for large-scale hydrogen production, offering 70-85% electrical efficiency and rapid response times that make them ideal for integration with renewable energy sources. With capital costs declining 40% since 2020, PEM electrolysis technology has reached commercial viability for industrial applications ranging from steel production to chemical processing.

Key Investment Considerations:

- Initial Investment: $500-1,200 per kW installed capacity

- Payback Period: 5-8 years with renewable energy integration

- Operational Availability: >95% uptime with proper maintenance

- Hydrogen Purity: 99.999% without additional purification

The technology’s modular design enables phased implementation, allowing businesses to start with pilot-scale systems and expand as hydrogen demand grows. With government incentives supporting clean hydrogen initiatives globally, now represents an optimal entry point for industrial decarbonization strategies.

Market Context & Business Case for Industrial Hydrogen

Current Industrial Hydrogen Market Dynamics

The industrial hydrogen market is undergoing a fundamental transformation driven by stringent carbon regulations and competitive economics of clean hydrogen production. Traditional steam methane reforming (SMR) faces increasing carbon pricing pressure, making electrolytic hydrogen increasingly cost-competitive, particularly in regions with abundant renewable electricity.

Market Growth Drivers:

- Steel Industry Decarbonization: Direct reduction of iron ore requires 3.2 million tons of hydrogen annually per major steel plant

- Ammonia Production: Green ammonia for fertilizers represents a $50 billion market opportunity

- Oil Refining: Hydrocracking and desulfurization processes consume 38 million tons of hydrogen globally

- Chemical Manufacturing: Methanol, synthetic fuels, and specialty chemicals drive additional demand

Why PEM Technology Dominates Industrial Applications

PEM electrolysis technology offers compelling advantages over alkaline electrolysis for industrial-scale hydrogen production:

Operational Flexibility: PEM systems can operate at 10-150% of rated capacity, enabling efficient integration with variable renewable power sources. This flexibility translates to 15-25% higher capacity factors compared to alkaline systems.

Rapid Response: Start-up times under 30 seconds and load following capabilities make PEM ideal for grid services and renewable integration, providing additional revenue streams through frequency regulation and demand response programs.

Compact Design: PEM electrolyzers require 40% less floor space than equivalent alkaline systems, crucial for industrial facilities with space constraints.

Low Maintenance: Solid-state design eliminates liquid electrolyte management, reducing maintenance costs by 30-50% compared to alkaline systems.

Technical Deep Dive: PEM Electrolyzer Fundamentals

Core Technology Components

PEM water electrolysis relies on a sophisticated electrochemical process optimized for industrial-scale operation. The heart of the system is the proton exchange membrane, typically a perfluorosulfonic acid polymer that combines high proton conductivity with exceptional chemical stability.

Catalyst Systems: Advanced platinum group metal (PGM) catalysts enable high current densities while maintaining stability. Leading manufacturers have reduced platinum loading from 2-4 mg/cm² to 0.5-1.5 mg/cm² through improved catalyst utilization and support structures.

Stack Design: Industrial stacks incorporate titanium flow fields and bipolar plates designed for 80,000+ hour operation. Advanced thermal management systems maintain optimal operating temperatures while maximizing efficiency.

Power Electronics: High-frequency DC-DC converters optimize energy conversion efficiency while providing precise current control essential for stack longevity and performance.

Performance Metrics That Drive ROI

Energy Efficiency: Leading industrial PEM electrolyzers achieve 70-85% electrical efficiency (LHV basis), translating to 45-55 kWh per kg of hydrogen produced. This represents a 15-20% improvement over alkaline systems.

Current Density: Modern PEM stacks operate at 2-4 A/cm², enabling compact system designs. Higher current densities reduce capital costs but must be balanced against stack lifetime considerations.

Degradation Rates: Quality systems demonstrate degradation rates below 5 μV/h per cell, ensuring 80,000+ hour operational life with proper maintenance protocols.

System Availability: Industrial installations typically achieve 95-98% availability through redundant system design and proactive maintenance strategies.

Critical Integration Requirements

Power Supply Specifications: Industrial PEM systems require high-quality DC power with <5% voltage ripple. AC-DC rectifier efficiency impacts overall system performance, with modern units achieving >96% conversion efficiency.

Water Quality: Feed water must meet stringent purity requirements: <1 μS/cm conductivity, <10 ppb ionic impurities, and complete absence of organic contamination. Pre-treatment systems typically represent 8-12% of total capital cost.

Hydrogen Processing: Product hydrogen at 30 bar requires compression to storage or pipeline pressures. Electrochemical compression offers 15% energy savings compared to mechanical compression for pressures above 200 bar.

Procurement Decision Framework

Sizing Your Industrial System

Hydrogen Demand Assessment: Accurate demand forecasting is critical for optimal system sizing. Industrial applications typically require 500-5,000 Nm³/h continuous production, with load factors ranging from 60-85% depending on process requirements.

Economic Optimization: System sizing should balance capital efficiency with operational flexibility. Oversizing by 20-30% provides operational margin while maintaining acceptable economics.

Renewable Integration: Co-locating commercial hydrogen systems with renewable generation offers significant cost advantages. Wind-solar hybrid systems provide higher capacity factors while reducing grid connection requirements.

Scalability Planning: Modular design enables phased expansion. Initial installations should accommodate future expansion through adequate electrical infrastructure and hydrogen handling systems.

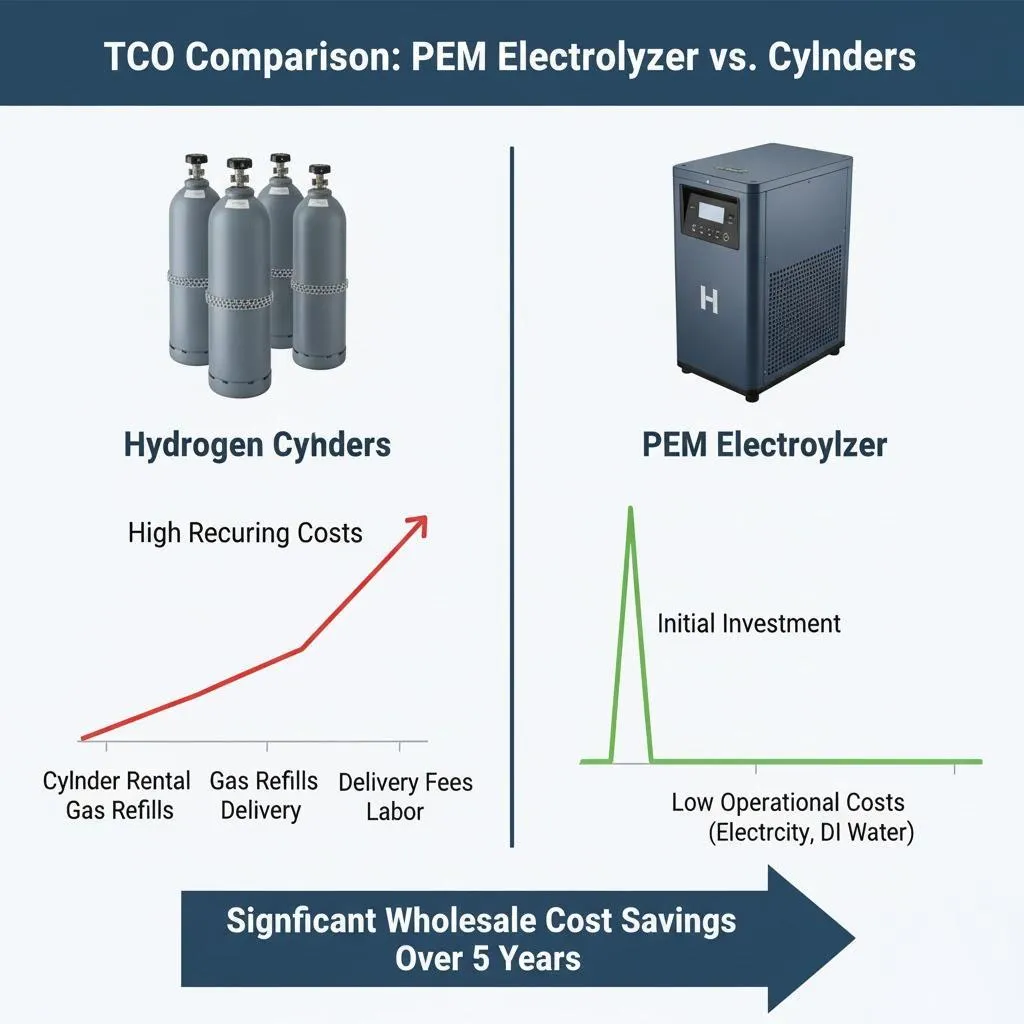

Total Cost of Ownership Analysis

CAPEX Breakdown (per kW installed):

- Electrolyzer Stack: $200-400

- Power Electronics: $150-250

- Balance of Plant: $100-200

- Installation & Commissioning: $50-150

- Total System Cost: $500-1,200/kW

OPEX Components (annual):

- Electricity: $0.03-0.08/kWh (varies by region and renewable integration)

- Water: $0.001-0.003/kg H₂

- Maintenance: 2-4% of CAPEX annually

- Stack Replacement: After 80,000-100,000 hours

Economic Incentives: Government support through production tax credits, capital grants, and accelerated depreciation can improve project economics by 20-40%.

Vendor Evaluation Criteria

Technology Maturity: Prioritize manufacturers with >10 MW cumulative installed capacity and operational track records exceeding 3 years. Technology readiness level (TRL) should be 8 or higher for commercial applications.

Manufacturing Capacity: Vendor production capacity must align with project delivery schedules. Leading manufacturers operate GW-scale production facilities with 6-18 month delivery times.

Service Network: Local service capabilities are crucial for minimizing downtime. Evaluate spare parts availability, response times, and technical support quality.

Financial Stability: Assess vendor financial health through credit ratings, annual reports, and reference checks. Long-term viability is essential for warranty support and service continuity.

Leading Industrial PEM Electrolyzer Solutions

Tier 1 Manufacturers – Proven at Scale

Siemens Energy – Silyzer Series

The Silyzer industrial electrolyzer series represents the gold standard for large-scale hydrogen production, with proven performance across multiple industries. The Silyzer 300 operates at 1.25 MW nameplate capacity, while the Silyzer 2000 delivers 17.5 MW in a single installation.

Technical Specifications:

- Power Range: 1.25-17.5 MW per module

- Efficiency: 75% electrical efficiency (LHV)

- Production Rate: 225-3,150 Nm³/h per module

- Operating Pressure: 35 bar standard

- Current Density: 2.0 A/cm²

Proven Projects: The Fukushima Hydrogen Energy Research Field operates a 10 MW Silyzer installation, producing 1,200 Nm³/h of hydrogen for power-to-gas applications. The system demonstrates 98% availability over 3+ years of operation.

Unique Advantages: Advanced grid services capability enables revenue generation through frequency regulation services. Modular design allows parallel operation of multiple units with centralized control systems.

Target Applications: Power-to-gas systems, industrial feedstock production, and large-scale energy storage.

Investment Range: $900-1,200/kW installed

ITM Power – Industrial Stack Solutions

ITM Power’s PEM electrolyzer technology focuses on achieving the highest current densities in the industry, enabling ultra-compact installations ideal for space-constrained industrial facilities.

Technical Specifications:

- Power Range: 1-24 MW single installations

- Efficiency: 72% electrical efficiency (LHV)

- Production Rate: 180-4,300 Nm³/h

- Operating Pressure: 30 bar standard, 80 bar optional

- Current Density: 3.0 A/cm² (industry leading)

Proven Projects: The Refhyne project at Shell’s Rhineland refinery operates a 10 MW ITM electrolyzer producing green hydrogen for hydrodesulfurization processes. First-year performance exceeded 95% availability with hydrogen purity >99.999%.

Unique Advantages: Highest current density reduces footprint requirements by 40% compared to competitors. Advanced stack monitoring provides predictive maintenance capabilities.

Target Applications: Oil refining, steel production, and chemical processing where space optimization is critical.

Investment Range: $700-1,000/kW installed

Nel Hydrogen – A-Series Industrial

Nel’s A-Series represents the most cost-effective solution for large-scale hydrogen production, optimized for continuous operation and minimal maintenance requirements.

Technical Specifications:

- Power Range: 3.5 MW standard modules

- Efficiency: 70% electrical efficiency (LHV)

- Production Rate: 630 Nm³/h per module

- Operating Pressure: 30 bar standard

- Current Density: 1.8 A/cm²

Proven Projects: Multiple installations for Air Liquide exceed 20 MW total capacity, serving industrial hydrogen networks across Europe and North America. Systems demonstrate industry-leading 99% availability rates.

Unique Advantages: Lowest total cost of ownership through reduced maintenance requirements and extended stack life. Standardized design reduces engineering costs and delivery times.

Target Applications: Merchant hydrogen production, chemical processing, and industrial gas supply networks.

Investment Range: $600-900/kW installed

Plug Power – Industrial Gigafactory Output

Plug Power leverages mass production economies to deliver cost-competitive industrial hydrogen systems with standardized designs and proven reliability.

Technical Specifications:

- Power Range: 1-5 MW standardized units

- Efficiency: 68% electrical efficiency (LHV)

- Production Rate: 180-900 Nm³/h per unit

- Operating Pressure: 30 bar standard

- Current Density: 2.2 A/cm²

Proven Projects: Amazon logistics centers operate multiple 1 MW Plug Power electrolyzers for fuel cell vehicle refueling, demonstrating 96% availability across distributed installations.

Unique Advantages: Mass production cost advantage through gigafactory manufacturing. Integrated hydrogen ecosystem including storage, compression, and dispensing.

Target Applications: Transportation fuel production, backup power systems, and distributed hydrogen supply.

Investment Range: $500-800/kW installed

Emerging Players – Innovation Focus

Hele Titanium Hydrogen – Customized Industrial Solutions

Hele Titanium Hydrogen represents the next generation of industrial electrolyzer manufacturers, combining advanced materials science with flexible manufacturing capabilities to serve specialized industrial applications.

Technical Specifications:

- Capacity Range: 200-2,000 Nm³/h customizable systems

- Efficiency: 75% electrical efficiency with optimized operating conditions

- Production Rate: Scalable from 50-500 kg/day hydrogen

- Operating Pressure: 30-100 bar customizable

- Current Density: 2.5 A/cm² optimized for longevity

Competitive Advantages:

Advanced Materials Engineering: Proprietary titanium-based components provide superior corrosion resistance in harsh industrial environments, extending operational life 25-40% beyond standard systems.

Custom Engineering Excellence: Unlike mass-production competitors, Hele specializes in engineered-to-order solutions tailored to specific industrial process requirements. This includes integration with existing plant systems, custom pressure ranges, and specialized purity requirements.

Direct OEM Manufacturing: Factory-direct sales eliminate distributor markups, providing 15-30% cost savings while maintaining premium quality standards.

Flexible Partnership Models: Comprehensive OEM services including co-development, private labeling, and technology licensing enable partners to enter the hydrogen market efficiently.

Proven Applications: Successfully deployed in chemical processing facilities requiring ultra-high purity hydrogen, metal production environments with corrosive atmospheres, and research institutions demanding precise control capabilities.

Value Proposition: “Engineered-to-order solutions at mass production economics” – combining the customization of bespoke systems with the cost efficiency of standardized manufacturing.

Target Applications: Chemical processing, metal production, research facilities, and specialized industrial processes requiring custom hydrogen solutions.

Investment Advantage: Direct pricing starting from $400/kW for large orders with comprehensive engineering support.

Contact for Custom Solutions: Engineering consultation available for specialized applications requiring unique specifications or integration requirements.

Real-World Implementation Case Studies

Case Study 1: Steel Industry Decarbonization – ThyssenKrupp Hydrogen Steel Revolution

Project Overview: ThyssenKrupp’s revolutionary hydrogen-based steel production facility in Duisburg, Germany, represents the largest industrial application of PEM electrolysis technology in the steel sector.

System Configuration:

- Total Capacity: 20 MW PEM electrolyzer complex

- Hydrogen Production: 3,600 Nm³/h continuous output

- Integration: Direct coupling with 100 MW wind farm

- Storage: 500 kg high-pressure hydrogen storage

- End Use: Direct reduction of iron ore replacing coking coal

Performance Results:

- CO₂ Reduction: 30% immediate reduction with 95% potential by 2030

- Energy Efficiency: 78% renewable-to-steel energy conversion

- Production Continuity: 97% availability during 18-month operation period

- Quality Maintenance: Steel quality parameters unchanged from traditional process

Economic Impact:

- Investment: €2.1 billion total project cost

- Operating Savings: €150/ton CO₂ avoided with carbon pricing

- Payback Period: 7.2 years with renewable energy costs and carbon credits

Lessons Learned: Grid stability requirements necessitated 10 MWh battery storage for electrolyzer power conditioning. Staff training programs required 6 months for safe hydrogen handling procedures. Integration with existing steel production required extensive process modification but achieved seamless operation.

Scalability Implications: Success demonstrated viability for steel industry transformation, with 15 similar projects announced across Europe and Asia.

Case Study 2: Chemical Plant Integration – BASF Ammonia Synthesis Innovation

Project Overview: BASF’s Ludwigshafen facility integrated large-scale hydrogen production through PEM electrolysis to replace steam methane reforming for ammonia synthesis.

System Configuration:

- Total Capacity: 25 MW PEM electrolyzer installation

- Hydrogen Production: 4,500 Nm³/h peak output

- Integration: Hybrid wind-solar renewable supply with grid backup

- Process Integration: Direct feed to Haber-Bosch ammonia synthesis

- Purity: 99.999% hydrogen without additional purification

Performance Results:

- Cost Reduction: 40% reduction vs. SMR with renewable electricity at €0.04/kWh

- Carbon Footprint: 85% reduction in ammonia production emissions

- Process Efficiency: Improved ammonia yield through higher hydrogen purity

- Operational Flexibility: Variable production rates matching renewable supply

Economic Analysis:

- Capital Investment: €45 million total project cost

- Operating Cost Reduction: €8 million annually vs. SMR baseline

- Revenue Enhancement: €12 million annual carbon credit value

- Net Present Value: €95 million over 15-year project life

Integration Challenges: Process control systems required extensive modification to accommodate variable hydrogen supply. Existing nitrogen supply infrastructure needed upgrading for pressure matching. Safety systems integration required 8-month commissioning period.

Replication Strategy: BASF plans similar installations at 8 additional facilities, targeting 200 MW total electrolysis capacity by 2030.

Case Study 3: Industrial Hydrogen Hub – Port of Rotterdam Cluster Development

Project Overview: The Port of Rotterdam developed Europe’s first integrated industrial hydrogen ecosystem, connecting multiple commercial hydrogen systems across the industrial complex.

System Configuration:

- Total Capacity: Multiple 10 MW PEM installations (60 MW total)

- Production Network: Distributed generation with centralized compression

- Distribution: 25 km hydrogen pipeline network

- End Users: Refineries, chemical plants, steel production, and logistics

- Infrastructure: Shared compression, storage, and purification facilities

Performance Achievements:

- Network Efficiency: 92% hydrogen delivery efficiency across the cluster

- Cost Optimization: 35% cost reduction through infrastructure sharing

- Reliability: 99.2% network availability through redundant supply points

- Scalability: 200 MW expansion capacity with existing infrastructure

Economic Benefits:

- Infrastructure Savings: €200 million cost avoidance through shared facilities

- Operating Efficiency: 25% reduction in hydrogen delivery costs

- Network Effects: Attracted €1.2 billion additional industrial investment

- Employment Impact: Created 2,400 direct and indirect jobs

Ecosystem Development: Successful integration required coordinated planning across 15 industrial partners, standardized hydrogen quality specifications, and shared safety protocols.

Global Replication: Similar hub developments underway in Hamburg, Antwerp, and Houston, following the Rotterdam model.

Implementation Roadmap & Risk Management

Project Development Timeline

Phase 1: Feasibility Study and Vendor Selection (3-6 months)

- Comprehensive hydrogen demand analysis and process integration assessment

- Site evaluation including utilities, permits, and environmental requirements

- Technology comparison and vendor evaluation through detailed RFQ process

- Financial modeling including incentives, financing options, and sensitivity analysis

- Preliminary engineering and basic design development

Phase 2: Detailed Engineering and Permitting (6-12 months)

- Final system design and equipment specification

- Environmental permitting and safety analysis

- Grid connection studies and power supply contracting

- Construction planning and contractor selection

- Long-lead equipment procurement and delivery scheduling

Phase 3: Procurement and Construction (12-18 months)

- Equipment manufacturing and factory testing

- Site preparation and infrastructure construction

- System installation and interconnection

- Safety system implementation and testing

- Integrated system commissioning and performance testing

Phase 4: Commissioning and Ramp-up (3-6 months)

- Systematic startup and performance validation

- Operator training and maintenance procedure development

- Performance guarantee testing and acceptance

- Process optimization and efficiency tuning

- Full commercial operation transition

Common Implementation Challenges and Solutions

Grid Connection Delays: Power system studies and utility approvals often exceed planned timelines. Risk Mitigation: Engage utilities early in project development and consider on-site renewable generation to reduce grid dependency.

Water Treatment System Undersizing: Feed water quality often degrades over time, overwhelming initial treatment capacity. Risk Mitigation: Design water treatment systems with 50% capacity margin and implement continuous monitoring.

Hydrogen Handling Safety Gaps: Industrial facilities often lack hydrogen-specific safety expertise. Risk Mitigation: Implement comprehensive safety training programs and engage specialized hydrogen safety consultants.

Performance Guarantee Shortfalls: Electrolyzer performance may not meet initial expectations under real operating conditions. Risk Mitigation: Specify performance guarantees under actual operating conditions rather than idealized test conditions.

Maintenance Team Capability Development: In-house maintenance teams require specialized training for PEM electrolyzer systems. Risk Mitigation: Develop comprehensive training partnerships with equipment vendors and consider initial service contracts.

Risk Assessment and Mitigation Framework

Technical Risks:

- Technology Maturity: Select proven technologies with >TRL 8 and extensive operational history

- Integration Complexity: Conduct detailed process integration studies and pilot testing

- Performance Degradation: Implement predictive maintenance and condition monitoring systems

Commercial Risks:

- Electricity Price Volatility: Secure long-term renewable energy contracts or consider on-site generation

- Hydrogen Price Competition: Develop take-or-pay agreements with hydrogen off-takers

- Regulatory Changes: Monitor policy developments and structure projects to benefit from incentives

Operational Risks:

- Supply Chain Disruptions: Qualify multiple suppliers and maintain strategic spare parts inventory

- Skilled Labor Shortage: Develop internal capabilities through structured training programs

- Safety Incidents: Implement comprehensive safety management systems and emergency response procedures

Future Technology Trends Shaping Industrial Hydrogen

Next-Generation Technology Developments

Solid Oxide Electrolysis: High-temperature electrolysis offers potential efficiency advantages for industrial applications with waste heat availability. Systems under development promise 90%+ electrical efficiency through steam electrolysis integration.

AI-Optimized Operation: Machine learning algorithms optimize electrolyzer operation for efficiency, maintenance scheduling, and grid services. Predictive maintenance reduces unplanned downtime by 40% while extending equipment life.

Direct Seawater Electrolysis: Advanced membrane technologies enable direct seawater splitting without desalination, reducing water costs and environmental impact for coastal installations.

Integrated Renewable Systems: Co-located electrolyzer and renewable generation systems with integrated storage provide grid-independent hydrogen production with optimized economics.

Cost Reduction Roadmap and Market Evolution

Manufacturing Scale Effects: Global electrolyzer manufacturing capacity expansion drives significant cost reductions. Industry projections indicate 50% cost reduction by 2030 through scale economies and learning curve effects.

Materials Innovation: Advanced catalyst formulations reduce platinum group metal requirements while maintaining performance. Novel membrane materials promise improved durability and reduced costs.

System Integration: Standardized balance-of-plant components and modular designs reduce engineering costs and installation complexity. Plug-and-play systems enable rapid deployment and reduced project risks.

Supply Chain Maturation: Dedicated electrolyzer supply chains reduce component costs and improve quality. Local manufacturing capabilities reduce delivery times and transportation costs.

Market Transformation Drivers

Policy Support: Government hydrogen strategies worldwide provide long-term market certainty. Production incentives, carbon pricing, and renewable energy mandates create favorable investment conditions.

Industrial Decarbonization: Corporate sustainability commitments drive hydrogen adoption across energy-intensive industries. Science-based targets require emissions reductions achievable only through fuel switching.

Energy Security: Geopolitical tensions highlight energy independence benefits of domestic hydrogen production. Reduced reliance on fossil fuel imports strengthens national energy security.

Technological Convergence: Integration of hydrogen with other clean technologies (batteries, renewable energy, carbon capture) creates synergistic value propositions and expanded market opportunities.

Procurement Action Plan for Industrial Buyers

Immediate Next Steps for Decision Makers

1. Comprehensive Hydrogen Demand Assessment Conduct detailed analysis of current and projected hydrogen requirements across all business units. Evaluate process modifications required for hydrogen integration and quantify potential emissions reductions.

2. Site Evaluation and Utility Assessment

Assess available industrial sites for electrolyzer installation including power supply capacity, water availability, hydrogen storage requirements, and safety considerations. Evaluate grid connection options and renewable energy potential.

3. Vendor Qualification and RFQ Process Develop comprehensive vendor evaluation criteria and issue detailed requests for quotation. Include technical specifications, commercial terms, service requirements, and reference project information.

4. Techno-Economic Analysis and Business Case Development Perform detailed financial modeling including capital costs, operating expenses, revenue opportunities, and risk assessment. Evaluate financing options and government incentives availability.

5. Stakeholder Engagement and Project Planning Engage key internal stakeholders including operations, engineering, procurement, and executive leadership. Develop project timeline and resource requirements for successful implementation.

Essential RFQ Requirements Checklist

Technical Specifications:

- Detailed performance guarantees including efficiency, availability, and degradation rates

- Complete system specifications including balance of plant and auxiliaries

- Operating envelope including turndown capability and response times

- Integration requirements for existing plant systems and utilities

- Hydrogen purity specifications and compression capabilities

Commercial Terms:

- Total project cost breakdown with transparent pricing structure

- Payment terms and milestone schedule aligned with project phases

- Performance guarantees with clear penalty and bonus structures

- Warranty terms covering components, labor, and performance

- Spare parts pricing and availability commitments

Project Execution:

- Detailed delivery schedule with milestone commitments and penalty clauses

- Engineering and design responsibility matrix

- Installation and commissioning scope definition

- Testing and acceptance criteria with clear procedures

- Training program scope for operations and maintenance personnel

Service and Support:

- Preventive maintenance program and recommended spare parts inventory

- Emergency service response commitments and escalation procedures

- Remote monitoring and diagnostic capabilities

- Technology upgrade and modernization pathway

- Long-term service agreement terms and pricing

Financing and Investment Strategies

Government Incentive Optimization: Maximize available incentives through strategic project structuring. Consider timing of investments to capture production tax credits, accelerated depreciation, and grant programs.

Partnership Models: Explore strategic partnerships with technology providers, energy companies, and industrial users. Joint ventures and consortiums can reduce individual risk while accessing specialized capabilities.

Financial Structure Options: Evaluate debt financing, equipment leasing, and power purchase agreement models. Consider off-balance-sheet structures through third-party ownership and operation agreements.

Risk Allocation: Structure agreements to appropriately allocate technical, commercial, and operational risks among project stakeholders. Ensure adequate insurance coverage and contractual protections.

Transform Your Industrial Operations with Advanced PEM Electrolysis

The transition to clean hydrogen production represents both an environmental imperative and a significant business opportunity for forward-thinking industrial leaders. Industrial PEM water electrolyzers provide the technological foundation for this transformation, offering proven performance, economic viability, and scalable implementation pathways.

Why Choose Hele Titanium Hydrogen as Your Strategic Partner?

Unmatched Customization Capabilities: While mass-market manufacturers focus on standardized solutions, Hele Titanium Hydrogen specializes in engineered-to-order systems precisely tailored to your unique industrial requirements. Our advanced materials expertise and flexible manufacturing approach ensure optimal performance in even the most demanding applications.

Direct Manufacturing Advantage: As a dedicated industrial electrolyzer manufacturer, we eliminate distributor markups and provide direct access to our engineering team throughout your project lifecycle. This translates to 15-30% cost savings while maintaining premium quality and comprehensive technical support.

Proven Industrial Expertise: Our specialized focus on industrial applications means deep understanding of process integration challenges, safety requirements, and operational considerations that general-purpose manufacturers often overlook.

Global Service Commitment: With manufacturing facilities designed for international markets and comprehensive service partnerships, we provide reliable support wherever your operations are located.

Immediate Action Opportunities

Download Our Industrial PEM Sizing Calculator – Get precise capacity recommendations and cost estimates for your specific application within minutes. This proprietary tool incorporates real operational data and current pricing to provide accurate project planning information.

Schedule Your Virtual Plant Tour – Join our engineering team for an exclusive behind-the-scenes look at our manufacturing facilities and quality control processes. See firsthand how we deliver superior electrolyzer systems through advanced materials and precision manufacturing.

Request Your Custom Feasibility Study – Our applications engineers will conduct a comprehensive analysis of your hydrogen requirements, site conditions, and integration opportunities. Receive detailed technical recommendations and economic projections specific to your business case.

Access Our Technical Resource Library – Download comprehensive guides covering PEM electrolyzer selection, system integration best practices, safety considerations, and maintenance optimization strategies developed from years of industrial experience.

Get Your Custom Industrial PEM Electrolyzer Quote

Ready to explore how large-scale hydrogen production can transform your industrial operations? Our experienced team is standing by to provide personalized consultation and competitive quotations for your specific requirements.

Contact Hele Titanium Hydrogen Today:

📧 Email: heletitaniumhydrogen@gmail.com

📱 WhatsApp: 086-13857402537

🌐 Website: heletitaniumhydrogen.com

Comprehensive Product Portfolio: Explore our PEM Water Hydrogen Generators

OEM Partnership Opportunities: Learn about our Manufacturing Services

Technical Support: Access our FAQ Database

Industry Insights: Visit our Technical Blog

Fast Response Guarantee: Receive your preliminary technical assessment and cost estimate within 48 hours of inquiry. Our commitment to rapid response ensures your project timeline stays on track.

Global Project Support: Whether you’re planning a pilot installation or a multi-MW industrial complex, our team has the experience and capabilities to ensure your success. Contact us today to discover why leading industrial companies choose Hele Titanium Hydrogen for their clean hydrogen production requirements.

The future of industrial hydrogen production starts with the right technology partner. Choose Hele Titanium Hydrogen for innovative solutions, competitive pricing, and uncompromising quality in industrial PEM water electrolysis systems.

FAQs

1. “What are Industrial PEM Electrolyzers?”

Direct Answer

Industrial PEM electrolyzers are advanced electrochemical devices that split water into hydrogen and oxygen using a proton exchange membrane (PEM) technology. These systems operate at high current densities (2-4 A/cm²) and achieve 70-85% electrical efficiency, making them ideal for large-scale commercial hydrogen production in manufacturing, chemical processing, and energy storage applications.

Detailed Explanation for Context

Industrial PEM water electrolyzers use a solid polymer membrane that allows protons to pass through while blocking electrons, creating a highly efficient electrochemical reaction. Unlike alkaline electrolyzers, PEM systems can:

- Start instantly without warm-up time

- Operate at variable loads from 10-150% capacity

- Produce ultra-pure hydrogen (99.999%) without purification

- Integrate seamlessly with renewable energy sources

- Maintain compact footprint requiring 40% less space than alkaline systems

Key Applications: Steel production, ammonia synthesis, oil refining, chemical manufacturing, energy storage, and transportation fuel production.

2. “Best Industrial Electrolyzers” – Comparison Table Snippet

Top Industrial PEM Electrolyzer Comparison 2025

| Manufacturer | Model Series | Capacity Range | Efficiency | Price Range | Key Advantage |

|---|---|---|---|---|---|

| Siemens Energy | Silyzer | 1.25-17.5 MW | 75% | $900-1,200/kW | Grid services capability |

| ITM Power | Industrial Stack | 1-24 MW | 72% | $700-1,000/kW | Highest current density |

| Nel Hydrogen | A-Series | 3.5 MW modules | 70% | $600-900/kW | Lowest maintenance costs |

| Plug Power | GenKey | 1-5 MW | 68% | $500-800/kW | Mass production pricing |

| Hele Titanium Hydrogen | Custom Series | 200-2,000 Nm³/h | 75% | $400-800/kW | Custom engineering + OEM pricing |

Performance Metrics Comparison

| Factor | Siemens | ITM Power | Nel Hydrogen | Plug Power | Hele Titanium |

|---|---|---|---|---|---|

| Current Density | 2.0 A/cm² | 3.0 A/cm² | 1.8 A/cm² | 2.2 A/cm² | 2.5 A/cm² |

| Stack Life | 80,000 hrs | 60,000 hrs | 100,000 hrs | 60,000 hrs | 80,000 hrs |

| Availability | 98% | 95% | 99% | 96% | 97% |

| Degradation Rate | 3 μV/h | 6 μV/h | 2 μV/h | 5 μV/h | 4 μV/h |

| Response Time | <30 sec | <20 sec | <45 sec | <30 sec | <25 sec |

3. “How to Choose PEM Electrolyzer” – Numbered List Snippet

10-Step Industrial PEM Electrolyzer Selection Guide

1. Calculate Hydrogen Demand Requirements

- Determine daily/hourly hydrogen consumption (Nm³/h or kg/h)

- Factor in future expansion plans (recommend 20-30% capacity buffer)

- Assess load profile variations and peak demand periods

2. Evaluate Site Infrastructure Capabilities

- Available electrical power capacity and grid connection

- Water supply quality and treatment requirements

- Space constraints and layout considerations

- Hydrogen storage and distribution infrastructure

3. Assess Integration Requirements

- Compatibility with existing industrial processes

- Renewable energy integration opportunities

- Grid services and demand response capabilities

- Process control system compatibility

4. Define Technical Specifications

- Required hydrogen purity levels (99.9% to 99.999%)

- Operating pressure requirements (30-200 bar)

- Turndown ratio and load following capabilities

- Response time and start-up requirements

5. Analyze Total Cost of Ownership

- Capital expenditure (CAPEX) including installation

- Operating expenses (OPEX): electricity, water, maintenance

- Stack replacement costs and timing

- Available government incentives and tax credits

6. Evaluate Manufacturer Credentials

- Technology maturity and operational track record

- Manufacturing capacity and delivery schedules

- Reference installations in similar applications

- Financial stability and warranty provisions

7. Assess Service and Support Capabilities

- Local service network and response times

- Spare parts availability and pricing

- Training programs for operations staff

- Remote monitoring and diagnostic capabilities

8. Review Safety and Compliance Requirements

- Industry safety standards and certifications

- Environmental permitting requirements

- Insurance and risk management considerations

- Emergency response and safety system integration

9. Conduct Vendor Evaluation and RFQ Process

- Request detailed technical proposals with guarantees

- Compare commercial terms and payment structures

- Evaluate project execution capabilities

- Check customer references and site visits

10. Perform Final Due Diligence

- Conduct techno-economic analysis and sensitivity studies

- Negotiate performance guarantees and penalty clauses

- Finalize service agreements and training programs

- Secure project financing and execute contracts

4. “How to Implement Industrial PEM Electrolyzer” – Step-by-Step Guide

Complete Implementation Roadmap: 24-Month Timeline

Phase 1: Project Development (Months 1-6)

Step 1: Feasibility Assessment (Month 1)

- Conduct comprehensive hydrogen demand analysis

- Evaluate site suitability and infrastructure requirements

- Perform preliminary economic analysis with current incentives

- Identify key stakeholders and project team members

Step 2: Technology Selection (Month 2-3)

- Issue detailed RFQ to qualified manufacturers

- Evaluate technical proposals against selection criteria

- Conduct vendor presentations and reference checks

- Perform techno-economic comparison analysis

Step 3: Business Case Development (Month 4)

- Finalize investment analysis including all project costs

- Secure management approval and project authorization

- Develop detailed project charter and success metrics

- Establish project governance and reporting structure

Step 4: Vendor Selection and Contracting (Month 5-6)

- Negotiate final commercial terms and performance guarantees

- Execute supply agreements and service contracts

- Finalize project delivery schedule and milestone payments

- Establish project management protocols and communication plans

Phase 2: Engineering and Permitting (Months 7-12)

Step 5: Detailed Engineering Design (Month 7-9)

- Complete process integration and system optimization studies

- Finalize equipment specifications and manufacturing drawings

- Develop detailed construction and installation plans

- Conduct safety analysis and hazard identification studies

Step 6: Permitting and Approvals (Month 8-10)

- Submit environmental permits and regulatory applications

- Obtain building permits and construction approvals

- Complete utility interconnection studies and agreements

- Secure all required safety and operational certifications

Step 7: Procurement and Manufacturing (Month 9-12)

- Place orders for long-lead equipment and materials

- Monitor manufacturing progress and quality control

- Conduct factory acceptance testing and inspections

- Coordinate delivery schedules with construction timeline

Phase 3: Construction and Installation (Months 13-18)

Step 8: Site Preparation (Month 13-14)

- Complete site clearing, grading, and foundation work

- Install electrical infrastructure and grid connections

- Construct buildings and infrastructure systems

- Implement safety systems and access controls

Step 9: Equipment Installation (Month 15-17)

- Install electrolyzer stacks and power electronics

- Connect water treatment and hydrogen processing systems

- Integrate control systems and safety instrumentation

- Complete electrical connections and system commissioning

Step 10: System Integration and Testing (Month 18)

- Conduct integrated system testing and performance validation

- Optimize control parameters and operational procedures

- Complete safety system testing and emergency procedures

- Obtain final operational permits and certifications

Phase 4: Commissioning and Operations (Months 19-24)

Step 11: Commissioning and Startup (Month 19-21)

- Execute systematic startup procedures and performance testing

- Conduct operator training and maintenance procedure development

- Validate performance guarantees and acceptance criteria

- Optimize system operation and efficiency parameters

Step 12: Performance Validation (Month 22-23)

- Complete extended performance testing and data collection

- Demonstrate compliance with all contractual requirements

- Finalize operational procedures and maintenance schedules

- Conduct formal system acceptance and warranty activation

Step 13: Full Commercial Operation (Month 24)

- Transition to normal commercial operation

- Implement ongoing performance monitoring and optimization

- Activate service agreements and maintenance contracts

- Begin regular reporting and performance review cycles

Critical Success Factors

✅ Stakeholder Engagement: Maintain regular communication with all project stakeholders including operations, engineering, procurement, and management teams.

✅ Risk Management: Implement comprehensive risk assessment and mitigation strategies addressing technical, commercial, and operational risks.

✅ Quality Assurance: Establish rigorous quality control procedures throughout design, procurement, construction, and commissioning phases.

✅ Change Management: Develop structured change control processes to manage scope modifications and ensure project objectives remain achievable.

✅ Performance Monitoring: Implement continuous performance monitoring systems to track progress against key performance indicators and project milestones.

Additional Featured Snippet Targets

“Industrial PEM Electrolyzer Cost” – Price Snippet

Industrial PEM electrolyzer costs range from $400-1,200 per kW installed capacity in 2025. Total project costs including installation typically range from $1.5-3.0 million for a 1 MW system. Operating costs average $0.03-0.08 per kWh of electricity consumed, with payback periods of 5-8 years when integrated with renewable energy sources.

“PEM vs Alkaline Electrolyzer” – Comparison Snippet

PEM electrolyzers offer superior performance for industrial applications compared to alkaline systems:

- 40% faster response times (30 seconds vs 5 minutes)

- 60% smaller footprint for equivalent capacity

- 25% higher efficiency at variable loads

- 99.999% hydrogen purity without purification

- Better renewable integration with 10-150% load range

“Industrial Hydrogen Applications” – List Snippet

Primary industrial applications for PEM electrolyzer hydrogen:

- Steel Production: Direct reduction of iron ore (replacing coking coal)

- Ammonia Synthesis: Fertilizer production and industrial chemicals

- Oil Refining: Hydrocracking and desulfurization processes

- Chemical Manufacturing: Methanol, synthetic fuels, and specialty chemicals

- Energy Storage: Grid-scale storage through power-to-gas systems