Executive Summary

The global energy system is undergoing a fundamental transformation, driven by the dual imperatives of decarbonization and energy security. Within this transition, green hydrogen produced via water electrolysis has emerged as a critical vector for decarbonizing the hard-to-abate sectors where direct electrification is not feasible. Projections indicate that global hydrogen demand will surge to approximately 150-180 million tonnes (Mt) by 2030, with a significant portion of this growth originating from new industrial applications. This report provides a comprehensive technical guide for industrial decision-makers on the deployment of Proton Exchange Membrane (PEM) electrolysis, a key enabling technology for this revolution.

The analysis begins by establishing the market drivers and regulatory mandates compelling industries to shift from conventional gray hydrogen to clean alternatives. It then provides a deep technical examination of PEM electrolysis, detailing its operational advantages—including rapid dynamic response, high purity, and a compact footprint—which make it uniquely suited for integration with intermittent renewable energy sources and existing industrial infrastructure.

However, the path to industrial-scale deployment is not without its challenges. This report confronts these complexities head-on, offering a pragmatic analysis of the issues surrounding manufacturing scale-up, supply chain constraints for critical materials like iridium, and the often-underestimated intricacies of Balance of Plant (BoP) system integration. Through a series of real-world case studies in ammonia synthesis, green steel production, and oil refining, the report demonstrates that these challenges are being actively solved by pioneers in the field.

Ultimately, this report concludes that the successful transition to an industrial-scale green hydrogen economy requires more than just advanced components; it demands a holistic, system-level approach. Success hinges on selecting the right technology and, crucially, engaging a partner with the expertise to deliver customized, end-to-end solutions that de-risk the project from initial design through to final commissioning.

Section 1: The Industrial Imperative for Green Hydrogen

The transition towards a green hydrogen economy is no longer a distant prospect but an immediate commercial and strategic reality for heavy industry. Driven by stringent decarbonization targets, favorable government policies, and the falling cost of renewable energy, industrial players are now compelled to re-evaluate their long-term reliance on fossil-fuel-based hydrogen. This section outlines the market forces and economic rationale behind this urgent industrial pivot.

1.1 The Decarbonization Mandate: Beyond 2030 Targets

The scale of the anticipated hydrogen market is immense, representing one of the most significant industrial shifts of the 21st century. The International Energy Agency (IEA) forecasts that global hydrogen demand will increase by 1.5 times to reach around 150 Mt by 2030, with some scenarios aligned with Net-Zero Emissions (NZE) goals pushing this figure to 180 Mt. The most critical aspect of this forecast for industrial stakeholders is the source of this new demand. Currently, novel applications in heavy industry and long-distance transport account for less than 0.1% of hydrogen consumption; by 2030, they are expected to constitute almost 40% of demand in the NZE scenario. This signifies the opening of a vast, previously untapped market.

To meet these climate goals, the focus is squarely on clean hydrogen. The Hydrogen Council estimates that 75 Mt of clean hydrogen will be needed by 2030 to set the global energy system on a net-zero trajectory. This deployment could abate as much as 730 Mt of CO2 annually, an amount equivalent to the combined 2019 emissions of the UK, France, and Belgium.

While these targets from governing bodies and industry consortiums are ambitious, a divergence exists between stated goals and the current project pipeline. Analysis from BloombergNEF (BNEF) offers a more conservative “reality check,” forecasting a clean hydrogen supply of 16.4 million metric tons per year by 2030. This apparent gap between ambition and reality should not be interpreted as a sign of failure. Instead, it signals a massive and imminent market opportunity. The clear direction of policy and regulation indicates that demand is set to dramatically outstrip supply. For industrial enterprises, this means that early movers who invest in and secure reliable, on-site green hydrogen production technology will gain a significant competitive and economic advantage, insulating themselves from future carbon pricing and supply volatility. This market tension creates a powerful incentive to act decisively and invest in adaptable and scalable production solutions.

1.2 From Gray to Green: Navigating the Hydrogen Color Spectrum

The existing hydrogen market is dominated by “gray” hydrogen, produced from fossil fuels (primarily natural gas) without carbon capture, a process that is both carbon-intensive and increasingly at odds with global climate objectives. The transition to a sustainable future requires navigating the “hydrogen color spectrum,” which primarily involves “blue” hydrogen (produced from fossil fuels with carbon capture, utilization, and storage, or CCUS) and “green” hydrogen (produced via water electrolysis using renewable electricity).

The entire global economic and regulatory landscape is being reshaped to favor these clean hydrogen pathways. This is not an abstract trend but a series of concrete, financially significant policy actions. In the United States, the Inflation Reduction Act (IRA) created a tax credit of up to $3/kg for green hydrogen, fundamentally altering project economics. In Europe, Germany’s H2Global initiative is actively subsidizing the import of green hydrogen derivatives like ammonia and methanol to stimulate the market. Similarly, India has approved its National Green Hydrogen Mission with the explicit goal of producing 5 Mt of renewable hydrogen by 2030. These policies are designed to drive a rapid reduction in the average emissions intensity of hydrogen production, which in the IEA’s NZE Scenario is projected to fall from a current range of 11.3-13 kg

CO2-eq/kg H2 to 6.8-7.7 kg CO2-eq/kg H2 by 2030.

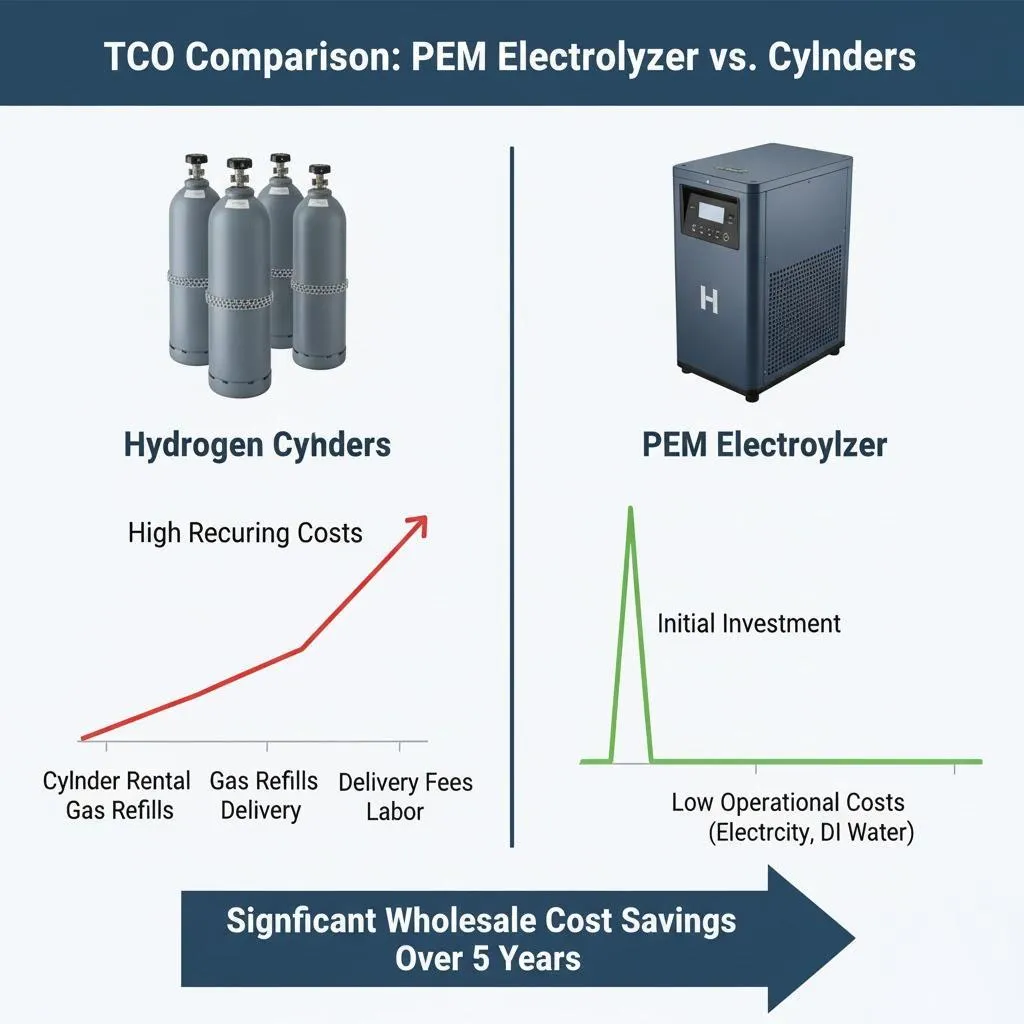

For industrial capital planners, this presents a critical strategic choice. Blue hydrogen is often positioned as a pragmatic, transitional step, leveraging existing fossil fuel infrastructure. However, a closer analysis of policy momentum and technology cost curves suggests a different long-term conclusion. The most powerful government incentives are overwhelmingly directed at green hydrogen. Concurrently, the levelized cost of renewable energy continues to fall, and electrolyzer manufacturing is scaling rapidly, leading to significant cost reductions. This creates a compelling argument for “leapfrogging” directly to green hydrogen. A direct investment in on-site green hydrogen production avoids the risk of investing in blue hydrogen infrastructure that could become a stranded asset as carbon taxes rise and green hydrogen becomes the cost-competitive standard. A thorough Total Cost of Ownership (TCO) analysis, modeled over a 20- to 30-year operational lifetime and factoring in projected cost reductions for green hydrogen, will likely favor a direct and decisive investment in PEM electrolysis technology.

Section 2: PEM Electrolysis: The Engine of Industrial Decarbonization

At the heart of the green hydrogen revolution lies the electrolyzer, the device that uses electricity to split water into hydrogen and oxygen. While several technologies exist, Proton Exchange Membrane (PEM) electrolysis has emerged as the leading choice for dynamic industrial applications due to a unique combination of performance characteristics. This section provides a detailed technical analysis of PEM technology, its core components, and its advantages over alternatives.

2.1 Beyond the Basics: Why PEM Excels in Industrial Environments

For an industrial operator, the choice of electrolyzer technology goes far beyond basic chemistry; it is a decision based on operational efficiency, reliability, and system-level economics. PEM technology offers distinct advantages that directly address the core challenges of industrial integration.

- Rapid Dynamic Response: The defining characteristic of PEM electrolysis is its ability to rapidly adjust power consumption in response to fluctuating inputs. This makes it exceptionally well-suited for direct coupling with intermittent renewable energy sources like solar and wind. Since the cost of electricity is the single largest variable in the Levelized Cost of Hydrogen (LCOH), the ability to harness the lowest-cost available renewable power, even when it is volatile, is a paramount economic advantage.

- High Power Density & Compact Footprint: PEM electrolyzers operate at a higher current density than traditional alkaline systems, resulting in a significantly smaller physical footprint for the same hydrogen output. This is a critical consideration for industrial facilities, where plant space is often limited and at a premium. The compact design simplifies site integration and can lead to lower overall installation costs.

- Superior Hydrogen Purity: PEM technology inherently produces ultra-pure hydrogen (≥99.99%) directly

from the cell stack. The solid polymer membrane acts as a highly effective barrier, preventing gas crossover and ensuring high-purity output without the need for extensive and costly downstream purification equipment. This is vital for applications with stringent purity requirements, such as in the semiconductor industry or for fueling PEM fuel cells, and it reduces the complexity and cost of the overall Balance of Plant. - High-Pressure Output: PEM electrolyzers are designed to operate at elevated pressures (e.g., 30 bar or higher), a capability that significantly reduces or, in some cases, eliminates the need for expensive and energy-intensive downstream mechanical compression. Since many industrial processes require pressurized hydrogen, this feature provides a direct and substantial saving in both capital expenditure (CAPEX) and operational expenditure (OPEX).

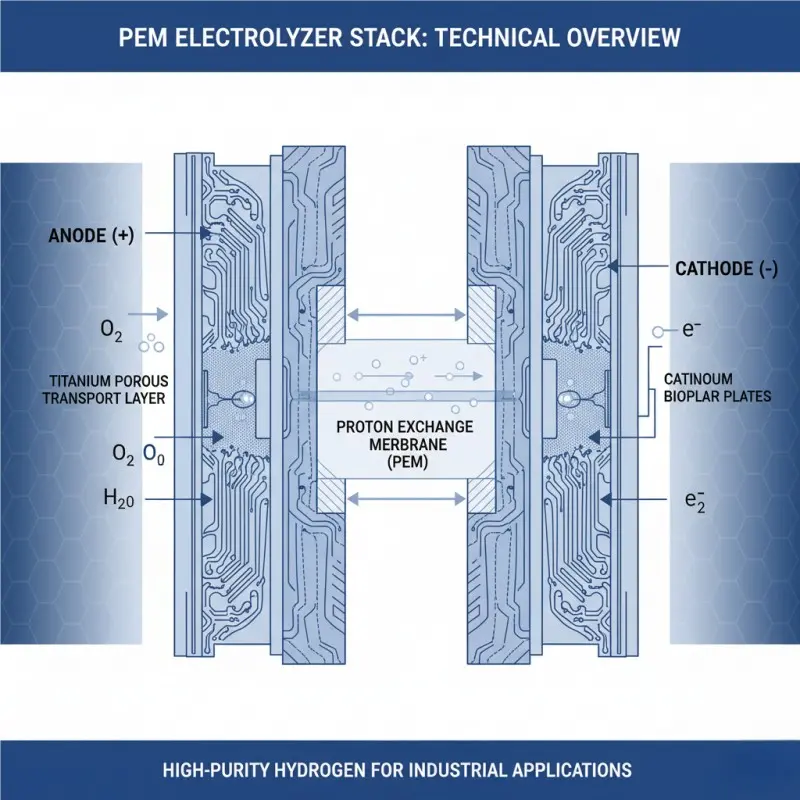

2.2 Anatomy of a Modern PEM Stack: A Look Inside the Core Technology

The performance, durability, and cost of a PEM electrolyzer are determined by the highly engineered components within its core, the electrochemical stack. Continuous advancements in materials science and manufacturing processes are driving improvements across these key components.

- Catalyst Coated Membrane (CCM): The CCM is the heart of the PEM stack. It consists of a thin solid polymer membrane, typically DuPont’s Nafion™, which is an excellent proton conductor but an electrical insulator. This membrane is coated on both sides with a catalyst layer. The anode (oxygen evolution side) uses a catalyst based on iridium, while the cathode (hydrogen evolution side) uses platinum. The efficiency and longevity of the stack are largely dependent on the properties of the CCM. Consequently, CCM production is a major focus of research and development, with a shift towards automated, continuous roll-to-roll manufacturing processes to improve quality, consistency, and cost-effectiveness.

- Porous Transport Layers (PTLs): Also known as Gas Diffusion Layers (GDLs), PTLs are positioned between the CCM and the bipolar plates. These components, typically made of sintered titanium, must perform several critical functions: distribute reactants (water) evenly across the catalyst surface, facilitate the removal of product gases (hydrogen and oxygen), and provide a robust electrical connection to the bipolar plates. R&D efforts are focused on optimizing the porosity of the titanium structure to improve mass transport and on reducing the amount of platinum-based coatings required for corrosion resistance and conductivity.

- Bipolar Plates (BPPs): BPPs form the structural backbone of the stack, providing separate flow channels for water, hydrogen, and oxygen for each cell. Unlike in PEM fuel cells, which can use graphite, the highly corrosive oxidative environment on the anode side of a PEM electrolyzer necessitates the use of titanium plates. These plates require thin coatings of precious metals (platinum on the anode side, gold on the cathode side) for corrosion protection and to ensure low electrical contact resistance. The manufacturing of these plates benefits significantly from advanced techniques developed in the fuel cell industry, with a focus on high-speed stamping and advanced coating technologies like Physical Vapor Deposition (PVD) to minimize material waste and reduce the use of precious metals.

A crucial factor that de-risks the adoption of PEM electrolysis for industrial use is its strong technological lineage. The core components and manufacturing techniques for PEM electrolyzers are closely related to those of PEM Fuel Cells (PEMFCs), a more mature technology with decades of development and industrialization, particularly in the automotive and stationary power sectors. The semi-automated and fully automated assembly lines developed for PEMFCs provide a “useful learning for set-up, automation and scale-up” of electrolyzer production. For a technical buyer concerned with technology risk and bankability, this connection is significant. It reframes PEM electrolysis not as a novel, high-risk technology, but as a robust and reliable application of a well-understood and validated technology platform.

2.3 A Pragmatic Comparison: PEM vs. Alkaline and Emerging Technologies

To make an informed investment decision, industrial stakeholders must understand the relative strengths and weaknesses of the available electrolyzer technologies. While PEM offers a compelling value proposition for dynamic applications, it is important to conduct an honest, data-driven comparison with established and emerging alternatives.

Alkaline Water Electrolysis (AEL) is the most mature technology, having been used in industrial applications for decades. Its primary advantage is a lower upfront capital cost for the stack, as it does not rely on expensive PGM catalysts. However, AEL systems use a liquid caustic electrolyte (potassium hydroxide), have slower response times to load changes, operate at lower current densities (requiring a larger footprint), and typically produce hydrogen at lower pressures, necessitating significant downstream compression.

Emerging technologies like Solid Oxide Electrolyzer Cells (SOEC) and Anion Exchange Membrane (AEM) electrolysis show promise. SOECs operate at very high temperatures (>600°C) and offer the highest system efficiencies, making them an excellent choice for integration with industrial processes that have available high-grade waste heat, such as steel or ammonia plants. AEM electrolyzers aim to combine the benefits of PEM (no liquid electrolyte) with the cost structure of AEL (no PGM catalysts), but the technology is still in the early stages of commercialization.

For many modern industrial applications, particularly those looking to leverage low-cost renewable power, the perceived CAPEX advantage of alkaline systems can be misleading. While AEL stacks are cheaper, the costs for both technologies nearly equalize when the expenses for downstream compression required for AEL systems are taken into account. Furthermore, PEM technology is on a steeper cost-reduction curve due to higher learning rates and manufacturing scale-up, with some analyses projecting it will become cheaper than alkaline in the future. When evaluating on a Total Cost of Ownership basis, PEM’s higher efficiency, operational flexibility, and lower Balance of Plant complexity often make it the superior long-term investment.

| Feature | Alkaline (AEL) | Proton Exchange Membrane (PEM) | Solid Oxide (SOEC) | Anion Exchange Membrane (AEM) |

| Technology Maturity | Mature, Commercial | Commercial, Growing | Nearing Commercial | Early Stage, Developing |

| System CAPEX ($/kW) | Lower | Higher (but decreasing) | High | Potentially Low |

| System Efficiency (% LHV) | Good (~60-70%) | Better (~65-72%) | Highest (>80% with heat integration) | Good (developing) |

| Response Time | Slower (minutes) | Fast (seconds) | Slower (minutes) | Fast (seconds) |

| Dynamic Range | Limited (20-100%) | Wide (5-150%) | Limited | Wide (developing) |

| H2 Purity (Direct) | Good (requires purification) | Excellent (>99.99%) | Excellent | Good (developing) |

| Output Pressure | Low (<30 bar) | High (30-70 bar) | Low (<15 bar) | Low-Medium |

| Footprint | Larger | Compact | Compact Stack, Large BoP | Compact |

| Durability (Lifetime) | High (80,000-90,000 hrs) | Moderate (40,000-80,000 hrs) | Moderate (developing) | Moderate (developing) |

| Key Advantage | Low CAPEX, Mature | Flexibility, Purity, Density | Highest Efficiency | Potential for Low Cost (No PGM) |

| Key Challenge | Caustic Electrolyte, Slow Response | PGM Catalyst Cost & Supply | High Temperature, Durability | Membrane Durability & Performance |

Table 1: Comparative Analysis of Leading Electrolyzer Technologies. Data compiled from multiple sources to provide a strategic overview for technical evaluation.

Section 3: Navigating the Challenges of Industrial-Scale Deployment

The transition from pilot projects to gigawatt-scale green hydrogen production presents significant technical, manufacturing, and economic challenges. Acknowledging and understanding these hurdles is the first step toward developing robust and successful industrial projects. This section provides a transparent assessment of the key challenges facing the PEM electrolysis industry and the innovative strategies being deployed to overcome them.

3.1 The Scale-Up Dilemma: From Megawatts to Gigawatts

The leap from producing individual megawatt-scale electrolyzer systems to establishing gigafactories capable of annually producing gigawatts of capacity is a formidable engineering and logistical challenge. Translating designs that perform well in a laboratory or small commercial unit to large-format industrial stacks is not a simple matter of multiplication. Issues such as ensuring uniform clamping force and gasket sealing across large-area cells become critical to prevent performance degradation and ensure safety and longevity.

This technical challenge is compounded by a complex market dynamic. In anticipation of a surge in demand, several leading manufacturers have invested heavily in building the world’s first gigafactories for electrolyzer production, such as ITM Power’s 1 GW/year facility in the UK. However, delays in Final Investment Decisions (FIDs) for many large-scale green hydrogen projects have created a temporary “chicken and egg” scenario, where manufacturing capacity is being built ahead of firm orders.

The industry’s solution to both the technical and economic aspects of scale-up lies in two key areas: automation and standardization. According to the International Renewable Energy Agency (IRENA), moving from today’s semi-automated assembly to fully automated production lines can reduce stack manufacturing costs by a remarkable 60-70%. This is achieved through more efficient production, improved build quality, and reduced labor costs. Furthermore, standardizing component designs and creating modular systems is critical for simplifying complex supply chains, reducing lead times, and driving down costs through economies of scale.

3.2 The Iridium Question and the Supply Chain Frontier

Perhaps the most significant long-term challenge for the widespread deployment of PEM electrolysis is its reliance on Platinum Group Metals (PGMs), particularly iridium, for its catalysts. This issue must be addressed transparently to build investor and customer confidence.

Iridium is one of the scarcest metals on Earth, with a total global production of only 7.9 tonnes in 2021. The supply is highly concentrated, with 89% originating as a byproduct of platinum mining in South Africa. Current PEM electrolyzer manufacturing, if operating at its full global capacity, would require approximately 1.0 tonne of iridium, or about 13% of the world’s annual supply. This clearly represents a potential bottleneck for scaling production to the multi-gigawatt levels required to meet decarbonization targets.

The industry is tackling this critical challenge aggressively through a multi-pronged strategy:

- Thrifting (Reduction): The most immediate and effective solution is to use less iridium. Through innovations in catalyst deposition techniques, such as advanced sputtering processes, manufacturers have dramatically reduced the required iridium loading. Loadings have fallen from 1-2 grams per kilowatt (g/kW) pre-2020 to as low as 0.3 g/kW in commercial products today, with laboratory tests demonstrating strong performance at just 0.1 g/kW.

- Substitution (Replacement): In parallel, extensive research is underway to find alternative, more abundant catalyst materials. Ruthenium oxide has shown promise as a potential replacement for iridium, and some startups, like H2U Technologies, have demonstrated completely iridium-free electrodes for PEM electrolyzers.

- Recycling (Recovery): Establishing a robust circular economy for PGMs is essential for long-term sustainability. Manufacturers are implementing recycling programs to recover and reuse the valuable platinum and iridium from end-of-life electrolyzer stacks, reducing the demand for newly mined materials.

3.3 System Integration: The Hidden Complexities of the Balance of Plant (BoP)

An electrolyzer stack, while being the core component, is only one part of a complete hydrogen production system. The surrounding equipment, collectively known as the Balance of Plant (BoP), is critical for the system’s overall performance, reliability, and cost. For industrial projects, the BoP can account for as much as 50% of the total capital cost and is a frequent source of operational problems if not designed and integrated correctly.

The BoP encompasses a wide range of subsystems, including:

- Power Electronics: High-voltage transformers and AC-to-DC rectifiers to supply the stack with controlled DC power.

- Water Purification: Systems to produce the high-purity deionized water required for PEM electrolysis.

- Gas Processing: Separators to remove water from the hydrogen and oxygen streams, and in some cases, purifiers and dryers.

- Thermal Management: Cooling systems to manage the waste heat generated by the electrolysis process.

- Downstream Equipment: Compressors for hydrogen storage and pipelines for distribution.

The complexity of integrating these subsystems is often underestimated. In a notable real-world example, industrial conglomerate Cummins recently confirmed that 15 of its large-scale electrolyzer units had to be shut down due to performance issues, which were likely related to the overall system integration rather than a fundamental flaw in the stacks themselves. This highlights a critical point for industrial buyers: the industry’s common focus on the stack’s capital cost, measured in dollars per kilowatt ($/kW), can be misleading. The ultimate measure of success is the Levelized Cost of Hydrogen (LCOH), which is far more dependent on the overall system’s efficiency, capacity factor, and reliability—all factors heavily influenced by the BoP. A low-cost stack integrated into a poorly designed or inefficient BoP will inevitably produce expensive and unreliable hydrogen. Therefore, the most effective procurement strategy should shift from purchasing a standalone component to procuring a complete, performance-guaranteed system from a partner with deep expertise in system-level integration.

Section 4: Green Hydrogen in Action: Real-World Industrial Applications

The theoretical advantages of PEM electrolysis are now being proven in demanding industrial environments around the world. Pioneering projects in the most carbon-intensive sectors are demonstrating that green hydrogen is not a future concept but a viable, scalable solution for deep decarbonization. This section examines real-world case studies in ammonia synthesis, steel manufacturing, and oil refining.

4.1 Case Study: Revolutionizing Ammonia Production

Ammonia (NH3) is one of the world’s most critical chemical commodities, with a global production of 235 million metric tons in 2019. Primarily used for fertilizers, it is also emerging as a carbon-free fuel and a stable carrier for transporting hydrogen. Traditionally, its production via the Haber-Bosch process is highly carbon-intensive due to its reliance on gray hydrogen from natural gas. Integrating green hydrogen from PEM electrolysis is now revolutionizing this industry.

- Iberdrola/Fertiberia, Spain: In Puertollano, Spain, one of Europe’s largest green hydrogen plants is now operational. The facility features a 20 MW PEM electrolyzer powered by a dedicated 100 MW solar PV plant. The green hydrogen produced is fed directly to a neighboring Fertiberia plant, enabling the production of approximately 17,000 tonnes of green ammonia per year. This project exemplifies the ideal pairing of PEM technology’s dynamic response with a dedicated, co-located renewable energy source.

- Yara, Norway: Global ammonia leader Yara is decarbonizing its existing plant in Porsgrunn, Norway, by integrating a 24 MW PEM electrolyzer from Linde. Leveraging Norway’s nearly 100% renewable electricity grid, this project will produce approximately 25,000 tonnes of green ammonia annually, demonstrating the viability of retrofitting green hydrogen production into established industrial facilities.

4.2 Case Study: Forging the Future of Green Steel

The iron and steel sector is responsible for a significant portion of global industrial emissions due to its reliance on coking coal in blast furnaces. One of the most promising “breakthrough technologies” for decarbonization is the use of green hydrogen as a direct reducing agent (DRI) to convert iron ore into iron, which is then processed in an electric arc furnace (EAF).

- H2FUTURE, Austria: This European flagship project, located at a voestalpine steel plant in Linz, features a 6 MW SILYZER PEM electrolyzer from Siemens Energy. The project’s primary goal is to test the integration of PEM technology on an industrial scale, demonstrating not only the production of green hydrogen for future steelmaking processes but also its capability to provide valuable grid balancing services by rapidly adjusting its power consumption.

- MASDAR/EMSTEEL, Abu Dhabi: In a first-of-its-kind initiative for the Middle East and North Africa (MENA) region, a pilot project at the EMSTEEL plant is leveraging green hydrogen from Ohmium PEM electrolyzers to produce green steel. This project showcases the global reach of green steel ambitions and the adaptability of PEM technology to challenging climatic conditions.

- Clean Hydrogen Coastline, Germany: Looking to the future, a planned project in Germany aims to build a 280 MW electrolysis plant specifically to supply green hydrogen to the local steel industry, with a projected avoidance of 800,000 tons of CO2 emissions annually. While these projects are pioneering, the scale of the challenge is immense; converting a single, average-sized European steel plant would require an electrolyzer installation of approximately 1.3 GW.

4.3 Case Study: Cleaning Up Refineries and Petrochemicals

Oil refineries are major consumers of gray hydrogen, which is used in critical processes like hydrocracking (breaking large hydrocarbon molecules) and hydrodesulfurization (removing sulfur from fuels to produce cleaner gasoline and diesel). Replacing this gray hydrogen with green hydrogen offers a direct path to reducing the carbon footprint of refined products.

- REFHYNE, Germany: The most significant project in this sector is the REFHYNE project at Shell’s Energy and Chemicals Park Rheinland in Wesseling, Germany. The first phase, REFHYNE 1, involved the installation and successful operation of a 10 MW PEM electrolyzer, which was Europe’s largest upon its startup in 2021. The project successfully demonstrated the use of green hydrogen for processing and upgrading refinery products, proving the technology’s readiness for this demanding industrial environment.

- REFHYNE 2: The success of the initial phase has been so compelling that Shell has taken a Final Investment Decision (FID) for REFHYNE 2. This ambitious expansion will see the installation of a 100 MW PEM electrolyzer at the same site. This ten-fold scale-up represents a powerful vote of commercial confidence and is a clear indicator that PEM electrolysis is a mature, bankable technology for decarbonizing the refining sector.

| Industrial Sector | Key Process Application | Role of Green Hydrogen | Primary Benefit | Required Electrolyzer Scale | Key Project Example |

| Ammonia Synthesis | Haber-Bosch Process | Replaces gray hydrogen as a feedstock for reacting with nitrogen. | Production of “green ammonia” for fertilizers and as a clean fuel. | 10-100+ MW | Yara Porsgrunn (24 MW) |

| Steel Manufacturing | Direct Reduced Iron (DRI) | Replaces coking coal as the reducing agent for iron ore. | Decarbonization of primary steelmaking, producing “green steel.” | 100 MW – 1.3+ GW per plant | H2FUTURE (6 MW) |

| Oil Refining | Hydrocracking & Hydrodesulfurization | Replaces gray hydrogen used to upgrade heavy crude and remove sulfur. | Reduces the carbon intensity of transportation fuels. | 10-100+ MW | REFHYNE 2 (100 MW) |

| Power-to-X (e-fuels) | Synthesis of e-Methanol, e-Kerosene | Provides the hydrogen backbone to be combined with captured CO2. | Production of carbon-neutral liquid fuels for aviation and shipping. | 100+ MW | H2Global Initiative |

| Semiconductor Mfg. | Chip Fabrication | Used as a high-purity carrier and cleaning gas in manufacturing. | Ensures ultra-high purity gas supply, critical for quality control. | 1-10 MW | Various On-site Systems |

Table 2: PEM Green Hydrogen Industrial Application Matrix. This table provides a strategic overview of key industrial applications, linking processes to benefits and real-world projects.

Section 5: Your Partner in Hydrogen Production: The Hele Titanium Advantage

The preceding sections have established that the transition to industrial-scale green hydrogen is a complex undertaking, requiring a deep understanding of market dynamics, advanced technology, and system-level engineering. The final, and perhaps most critical, decision in this journey is the selection of a partner. This section outlines how Hele Titanium’s tailored approach, comprehensive product portfolio, and commitment to partnership de-risk this transition and accelerate the path to successful project deployment.

5.1 From Component to Complete System: A Tailored Approach

Hele Titanium recognizes that every industrial application is unique and that a one-size-fits-all approach to hydrogen production is insufficient. The company’s core philosophy is built on providing customized solutions that are precisely engineered to meet the specific demands of each client’s operation. This flexible approach is reflected in a comprehensive product portfolio designed to support customers at every stage of their hydrogen journey, from initial research and development to full-scale industrial production.

The product range spans from small, compact 0.01-1 Nm³/h PEM electrolyzers, ideal for laboratory use, pilot projects, and applications like hydrogen-rich water machines, to large, industrial-grade 50-200 Nm³/h hydrogen generators engineered for the demands of hydrogen refueling stations, energy storage power plants, and chemical manufacturing.

Crucially, Hele Titanium is not merely a component supplier but a “direct source for PEM water electrolyzers,” offering “tailored designs that optimize your operations”. This capability directly addresses the critical need for sophisticated system-level engineering identified earlier in this report. By designing the complete system around the specific requirements of the application—whether it be for the semiconductor industry, microgrids, or polysilicon production—Hele Titanium ensures peak efficiency, reliability, and performance.

| Model Series | H2 Output Range (Nm³/h) | H2 Purity | Output Pressure | Key Features | Ideal Industrial Applications |

| Lab & R&D Series | 0.01 – 1 | ≥99.99% | Customizable | Compact, reliable, adaptable, no minimum order quantity. | Laboratory hydrogen supply, R&D, pilot projects, hydrogen inhalation devices. |

| Mid-Scale Industrial | 1 – 10 | ≥99.99% | Customizable | Scalable, consistent output, high-quality components. | Semiconductor industry, microgrid support, smaller power plants. |

| Large-Scale Industrial | 10 – 50 | ≥99.99% | Customizable | High performance, designed for reliability in continuous operation. | Hydrogen refueling stations, polysilicon production, chemical synthesis. |

| Heavy Industrial | 50 – 200+ | ≥99.99% | Customizable | Engineered for large-scale production and demanding duty cycles. | Large refueling stations, energy storage power plants, renewable energy integration |

Table 3: Hele Titanium Hydrogen PEM Electrolyzer Portfolio. This table showcases the range of tailored solutions available, from small-scale R&D units to large-scale industrial generators.

5.2 De-risking Your Transition: The Value of an Integrated Partnership

As this report has detailed, the greatest risks in a green hydrogen project often lie not within the electrolyzer stack itself, but in the complexities of system integration and commissioning. Hele Titanium mitigates these risks by positioning itself as “more than just a PEM electrolyzer manufacturer”—it acts as an integrated partner dedicated to the success of the entire project.

This partnership model delivers value far beyond the hardware itself. It encompasses critical services that directly address the primary challenges of industrial-scale deployment:

- Expert Consultation & System Design: Hele Titanium’s engineers work closely with clients from the outset to design and plan a complete hydrogen production system. This collaborative approach ensures that the Balance of Plant is perfectly matched to the electrolyzer and the specific application, optimizing performance and avoiding the costly integration failures that can plague complex projects.

- On-site Installation Support: The partnership extends from the design phase through to reality. Skilled Hele Titanium engineers are available to assist on-site, ensuring that the PEM electrolyzer system is installed, commissioned, and integrated smoothly into the client’s existing infrastructure. This hands-on support guarantees that the system runs correctly from day one.

- A Commitment to Project Success: The company’s ethos is centered on a long-term partnership. From the initial concept through design, planning, delivery, and installation, Hele Titanium remains engaged to ensure the final solution fully meets the client’s operational and financial objectives. This comprehensive, end-to-end support model provides the certainty and expertise needed to navigate the complexities of the energy transition.

5.3 Initiate Your Green Hydrogen Project: Contact Our Experts

The transition to industrial-scale green hydrogen is a complex but critical journey. Your success depends on making the right technological choices and working with a partner who understands the intricacies of system design and integration. Contact the Hele Titanium engineering team today for a comprehensive consultation on your specific application and discover how our tailored PEM electrolysis solutions can de-risk your project and accelerate your path to decarbonization.

Hele Titanium Hydrogen: Your Trusted Hydrogen Generator OEM & Manufacturing Partner

Hele Titanium Hydrogen stands as a reliable and experienced partner in the hydrogen generator OEM supply chain. We specialize in the design, development, and manufacturing of high-performance PEM Water Hydrogen Generators, offering comprehensive OEM & Manufacturing services tailored to your specific needs.

Take the Next Step

Ready to explore the possibilities of partnering with Hele Titanium Hydrogen?

- Browse our Products to see our range of PEM Water Hydrogen Generators.

- Learn more about our Services and how we can support your OEM & Manufacturing needs.

- Contact Us today to discuss your specific requirements.

- Explore our FAQ to get answers to common questions.

- Visit our Blog for the latest insights and updates on hydrogen technology.

Email Us: heletitaniumhydrogen@gmail.com

Phone/WhatsApp: 086-13857402537