Find out which hydrogen electrolyzers suit industrial needs best. From factory specs to delivery timelines—get the supplier edge you need for success.

Hele Titanium Hydrogen — OEM PEM electrolyzer supplier • wholesale hydrogen generator • hydrogen OEM manufacturing

Introduction

Demand for low-emission hydrogen is rising as heavy industries chase decarbonization targets and energy security. Global hydrogen consumption exceeded roughly 97 million tonnes in 2023, and governments and industry are accelerating investment in low-emission hydrogen production capacity. Electrolyzers — machines that use electricity to split water into hydrogen and oxygen — are central to that shift because they enable on-site, high-purity hydrogen when paired with renewable power. (IEA)

For industrial buyers, the key question is practical: which electrolyzer technology delivers the right mix of purity, reliability, delivery lead time and total cost of ownership for my process? This guide is written for procurement managers, plant engineers, and sustainability leads who evaluate suppliers and need a clear, commercially-oriented comparison that points to actionable next steps. We position Hele Titanium Hydrogen as a factory-direct OEM for PEM water hydrogen generators, explain how PEM stacks compare to alternatives, and give procurement-ready guidance (specs to ask for, risk points, and lead generation CTAs).

1. Quick primer: Electrolyzer technologies and where PEM fits

There are four commercially relevant electrolyzer families for industrial use:

- Alkaline (AWE) — mature, cost-effective at scale, uses liquid alkaline electrolyte. Good for large, steady loads; slower dynamic response.

- Proton Exchange Membrane (PEM) — uses a solid polymer membrane; delivers high purity, fast ramping, compact footprint and high pressure output. Ideal when purity, flexibility, or coupling with variable renewables is required.

- Anion Exchange Membrane (AEM) — emerging hybrid that promises lower materials cost; still maturing at industrial scale.

- Solid Oxide Electrolyzer Cells (SOEC) — high-temperature option with high theoretical efficiency; attractive where industrial heat is available but still limited commercially.

From an industrial procurement perspective, PEM electrolyzers are often the best fit where space is constrained, hydrogen purity is critical (e.g., electronics, fuel cells), or the site will pair electrolysis with variable renewables and needs fast start/stop. The U.S. Department of Energy (DOE) lists PEM electrolysis among the most promising pathways to lower cost, high-quality hydrogen through improved stacks, system design and durability targets. (The Department of Energy’s Energy.gov)

Practical numbers to hold in your head

- Typical grid-connected electrolysis today requires on the order of 50–55 kWh of electricity per kg H₂ (ambient-temperature electrolysis), with ongoing R&D targets to reduce that figure. Use this when modelling OPEX for a potential installation. (World Nuclear Association)

2. Why industrial buyers choose PEM (advantages & tradeoffs)

Advantages

- High purity hydrogen (suitable for fuel cells and semiconductors): PEM stacks have very low gas crossover and produce hydrogen that meets strict purity specs when paired with proper drying and filtration. (See ISO 14687 for fuel/industrial quality guidance.) (ISO)

- Fast dynamic response: PEM systems can ramp quickly to follow renewable power, supporting grid services or maximising green hydrogen production when solar/wind is available. (The Department of Energy’s Energy.gov)

- Compact footprint and high pressure operation: Saves plant floor space and can reduce downstream compression needs.

- Low parasitic water handling: Solid membrane avoids bulk liquid electrolytes, simplifying balance-of-plant.

Tradeoffs

- Higher CAPEX (today) than alkaline at large, steady scales — though stack costs are falling. Procurement must consider lifecycle OPEX and the value of flexibility.

- Materials & maintenance: PEM stacks use noble metal catalysts and specialized membranes; plan for stack replacement cycles and vendor support contracts.

- Supply chain & lead times: PEM modules are in demand; choose a supplier who provides predictable delivery windows and spare-parts availability.

3. Industry applications: where electrolyzers deliver value

Below are common industrial verticals, the hydrogen role in each, and the right technology match.

Steel & metallurgy

- Use case: Replace carbon feedstocks, reduce CO₂ from iron reduction or supply direct-reduction processes.

- Requirements: High daily throughput, robust operations, moderate hydrogen purity.

- Fit: Large alkaline or industrial PEM banks depending on space and ramping needs.

Chemicals & ammonia

- Use case: Hydrogen feedstock for ammonia/fertilizer; feed purity matters for downstream catalysts.

- Requirements: High reliability, predictable volumes, and certificates of origin for ‘green’ claims.

- Fit: PEM (for green, high-purity on-site production) or alkaline in large fixed installations.

Refineries & petrochemicals

- Use case: Hydrogen for hydrotreating and hydrocracking — traditionally from SMR. Green hydrogen provides decarbonization options.

- Requirements: Large volumes, integration with existing distribution.

- Fit: Hybrid approaches (large alkaline or clustered PEM modules).

Electronics / semiconductors

- Use case: Ultra-high purity hydrogen for process gas.

- Requirements: 99.999%+ purity and tight impurity control (ISO 14687 guidance applies).

- Fit: PEM electrolyzers with integrated purification and tight QA. (ISO)

Glass, metallurgy, and specialty manufacturing

- Use case: Combustion control, atmosphere management, and lower-carbon fuel.

- Requirements: Steady supply, safety controls, and on-site storage handling.

- Fit: Depending on volume, PEM or alkaline.

Mobility & refuelling

- Use case: H₂ for bus, truck and fleet refuelling stations.

- Requirements: Fast fill rates, high purity, compression.

- Fit: Compact PEM systems installed near dispensers.

Bottom line: map your process hydrogen purity requirement, duty cycle (continuous vs. flexible), and growth plan to the electrolyzer family — then evaluate suppliers on how they guarantee uptime, service, and delivery.

4. Key procurement considerations (what to ask your supplier)

When comparing quotes, use the checklist below. These are the commercial and technical items that separate low-risk suppliers from unknowns.

Technical

- Guaranteed hydrogen purity and test certificates (reference ISO 14687 where applicable). (ISO)

- Nominal production rate (Nm³/h or kg/day) at specified operating pressure and temperature.

- Electrical consumption (kWh/kg H₂) at rated conditions (important to model OPEX). (World Nuclear Association)

- Stack lifetime and degradation rate (mV/khr or % per 1,000 h) — affects replacement frequency. (The Department of Energy’s Energy.gov)

- Ramp rate and minimum turndown — for renewables integration.

Safety & compliance

- Pressure relief systems, hydrogen detectors, explosion-proof electrical design, and local code compliance. Ask for certificates and third-party inspection reports.

Commercial

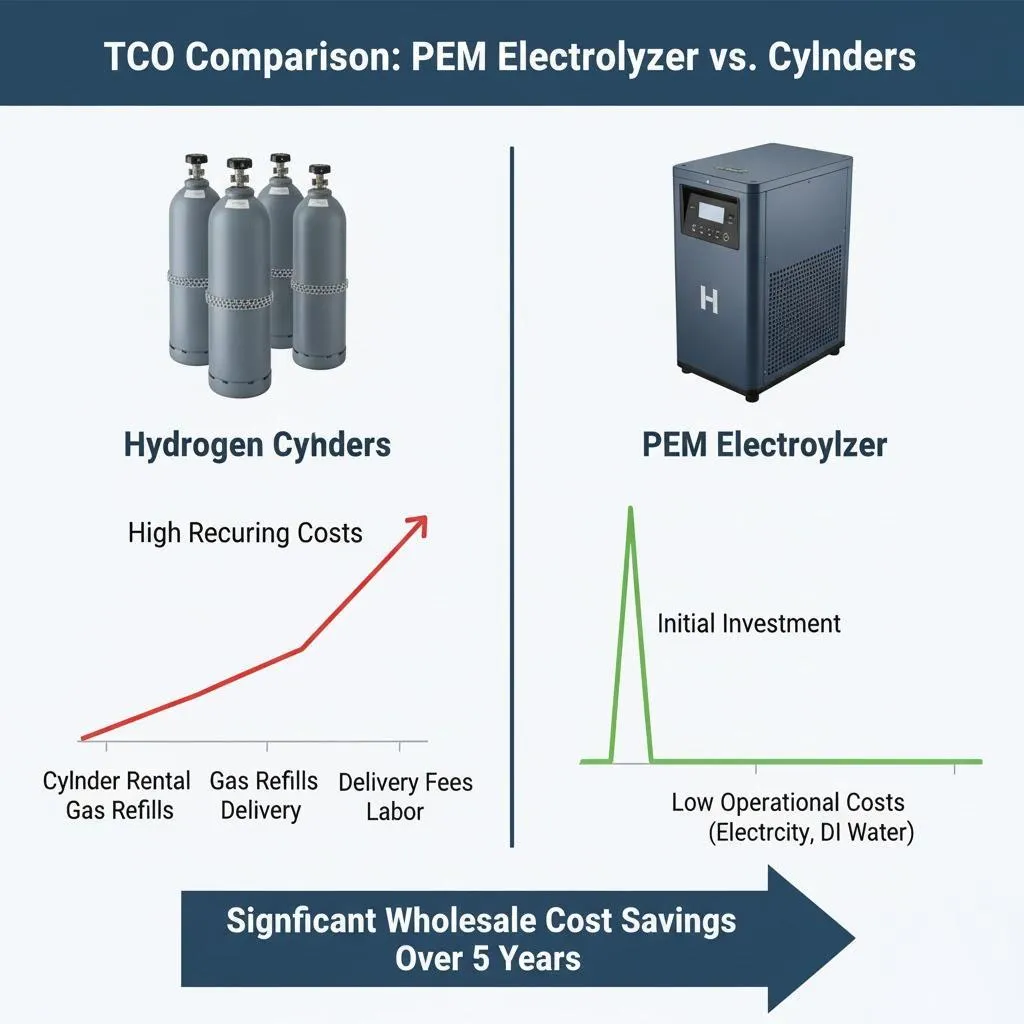

- CAPEX breakdown: electrolyzer modules, balance-of-plant, installation, civil works.

- OPEX model: electricity price sensitivity analysis (kWh/kg), water consumption (≈9 liters/kg H₂ is a useful rule of thumb), maintenance schedule, spares cost. (World Nuclear Association)

- Delivery lead time and manufacturing capacity: factory-direct OEMs can often compress lead time vs. resellers.

- After-sales support: remote monitoring, local service teams, warranty coverage, spare-parts availability.

- Financing & bundling: ask about lease, PPA, or bundling with renewable power.

Commercial negotiation tip: request a levelized cost of hydrogen (LCOH) scenario from each supplier using your local electricity price and expected utilization. LCOH is the single metric most decision-makers use to compare proposals.

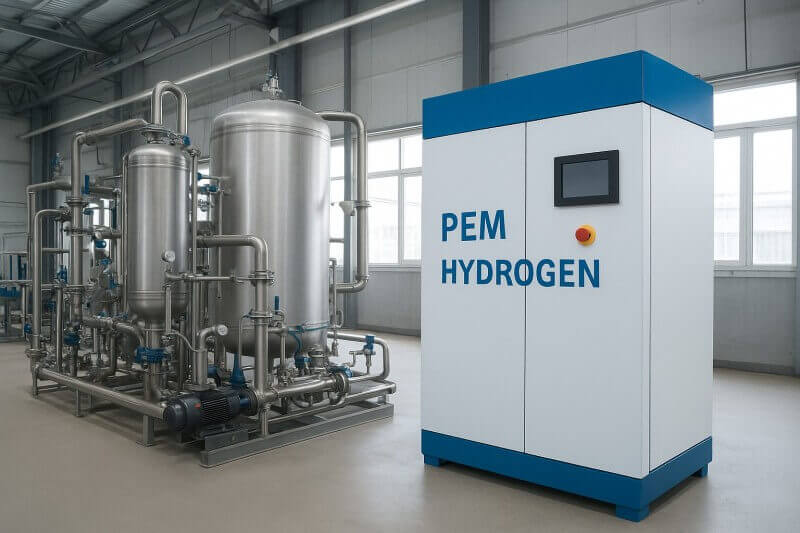

5. Supplier guide — Why choose Hele Titanium Hydrogen (PEM OEM & wholesale supplier)

Hele Titanium Hydrogen positions itself as a specialist PEM electrolyzer OEM focused on industrial customers who need factory-direct pricing, predictable delivery and customization.

What sets Hele apart (commercial strengths)

- PEM specialization: R&D and production focused on PEM stacks and system integration for industrial loads (refineries, electronics, mobility, specialty manufacturing).

- Factory-direct pricing: wholesale production that removes reseller markups — attractive for bulk purchase and multi-module rollouts.

- Customization and engineering support: turnkey balance of plant (BOP) design, skid integration, and tailored controls to match plant power profiles.

- After-sales & spare parts: stocked spare modules, remote monitoring, and global logistics support to reduce downtime risk.

- Compliance and documentation: supply of QA test reports, FAT (Factory Acceptance Test) protocols, and documentation to support regulatory approvals.

How Hele supports procurement

- Technical datasheet pack (stack specs, efficiency curves, mount dimensions).

- Site integration package (power drawings, hydrogen handling & safety design).

- TCO modelling support (we provide a spreadsheet you can plug your electricity rates into to estimate OPEX and payback).

6. Market context & cost outlook (what buyers should expect)

Electrolyzer tech and costs are rapidly evolving. DOE and industry roadmaps set ambitious efficiency and cost targets for PEM technology to enable lower hydrogen costs; governments and project developers are linking electrolyzer deployment to renewable build-outs and industrial decarbonization projects. The price per kg of electrolytic hydrogen today depends mainly on electricity cost and system CAPEX; achieving very low LCOH requires access to low-cost renewables and high capacity factors. (The Department of Energy’s Energy.gov)

Model assumption (rule-of-thumb):

- Electricity: if your site can source electricity under $30–40/MWh and utilization is high, electrolysis becomes economically attractive faster; otherwise the electricity line item dominates OPEX. (DOE analyses and practical projects demonstrate the sensitivity.) (The Department of Energy’s Energy.gov)

7. Representative case studies (anonymized / typical outcomes)

Note: the examples below are representative project outcomes based on typical PEM deployments and are provided to illustrate procurement value — exact results vary by process, electricity price, and site conditions.

Case A — Industrial chemicals plant (PEM, on-site green feedstock)

- Challenge: replace delivered SMR hydrogen with on-site green hydrogen to cut Scope 1 emissions and secure supply.

- Hele solution: 2 × 1 MW PEM modules modularly installed with local hydrogen storage and skid-mounted balance-of-plant.

- Outcome (representative): >90% uptime, reduced transport risk, and a projected payback under favorable renewable PPA within 6–9 years when accounting for carbon pricing and incentives.

Case B — Semiconductor fab (ultra-high purity hydrogen)

- Challenge: consistent 99.999% hydrogen for wafer processing with strict impurity control.

- Hele solution: PEM electrolyzer with integrated purification train and redundant delivery lines.

- Outcome (representative): delivered hydrogen that met strict impurity specifications per ISO guidance; avoided supply chain interruptions and reduced vendor gas cylinder logistics.

If you’d like, Hele can share anonymised FAT/commissioning reports and a redacted Project Completion Report after NDA to help you validate vendor claims.

8. How to evaluate quotes — a short procurement checklist

- Compare on LCOH, not just CAPEX. Include electricity scenarios.

- Ask suppliers for FAT video and stack performance curves. Verify at multiple current densities.

- Confirm spare parts lead times and stock locations. Downtime cost is often overlooked.

- Validate safety & compliance documentation. Third-party certificates reduce approval friction.

- Request references and case footage for similar industrial installs.

9. Future trends buyers should watch

- Scale & cost reduction: targets for lower kWh/kg and cheaper stacks continue to compress future LCOH. (CEEPR, The Department of Energy’s Energy.gov)

- AEM and SOEC maturation: these could be attractive alternatives in particular niches.

- Digital and predictive maintenance: AI monitoring will reduce OPEX and event-driven downtime.

- Policy and incentive landscape: production tax credits, grants and industrial decarbonization programs will materially affect project economics.

Conclusion — why partner with Hele Titanium Hydrogen

If your industrial operation needs high-purity, factory-direct PEM electrolyzers with competitive pricing, customization and robust after-sales support, Hele Titanium Hydrogen is positioned to be your OEM partner. We focus on delivering turnkey PEM water hydrogen generator systems for a range of industrial use cases — from chemical feedstock to semiconductor process gas and hydrogen refuelling.

Next steps (lead magnets & CTAs):

- Request a Quote: Send your hydrogen demand (kg/day or Nm³/h), desired pressure, and preferred delivery timeframe.

- Download our Technical Datasheet: Receive stack maps, efficiency curves and installation requirements (email heletitaniumhydrogen@gmail.com or use the contact form on our corporate site). (If you prefer a custom email, replace the example with your sales contact.)

- Book a free consultation: 30-minute technical session to review your site profile and a preliminary LCOH model.

FAQs

Q1 — What purity can Hele PEM electrolyzers achieve?

PEM systems combined with appropriate drying and filtration can supply hydrogen meeting stringent industrial and fuel-cell grades; discuss ISO 14687 requirements with your Hele technical contact. (ISO)

Q2 — How much electricity does electrolysis use?

Ambient-temperature electrolysis typically uses on the order of 50–55 kWh/kg H₂ today; improvements and higher efficiencies can reduce that number over time. Use your local electricity cost to model OPEX. (World Nuclear Association)

Q3 — What’s a realistic delivery lead time for PEM modules?

Depends on module size and backlog — factory-direct OEMs that stock core components can shorten lead time; always request a guaranteed delivery schedule in the contract.

Q4 — Are Hele systems compatible with renewables and grid-services?

Yes — PEM electrolyzers’ fast ramping makes them well suited to pair with variable renewable generation and participate in flexible operation strategies. (The Department of Energy’s Energy.gov)

Q5 — How often do PEM stacks need replacement?

Stack life and degradation vary by duty, water quality, and operating point. Request vendor performance targets (mV/khr or % degradation per 1,000 h) and plan a spare-stack inventory strategy. (The Department of Energy’s Energy.gov)

Q6 — Can Hele provide financing or PPA arrangements?

Hele works with partners that can support project finance or commercial arrangements in selected regions — ask your Hele sales rep for available options.

Hele Titanium Hydrogen: Your Trusted Hydrogen Generator OEM & Manufacturing Partner

Hele Titanium Hydrogen stands as a reliable and experienced partner in the hydrogen generator OEM supply chain. We specialize in the design, development, and manufacturing of high-performance PEM Water Hydrogen Generators, offering comprehensive OEM & Manufacturing services tailored to your specific needs.

Take the Next Step

Ready to explore the possibilities of partnering with Hele Titanium Hydrogen?

- Browse our Products to see our range of PEM Water Hydrogen Generators.

- Learn more about our Services and how we can support your OEM & Manufacturing needs.

- Contact Us today to discuss your specific requirements.

- Explore our FAQ to get answers to common questions.

- Visit our Blog for the latest insights and updates on hydrogen technology.

Email Us: heletitaniumhydrogen@gmail.com

Phone/WhatsApp: 086-13857402537